Briefly, this article will explain to you what an asset is and how an asset is accounted for in the financial statements. This article, however, will talk about the accounting for assets from the perspective of the MFRS framework. Nevertheless, entities under the IFRS framework also apply the same requirements as per what we will discuss in this article. Simply, because the MFRS framework is word-for-word with the IFRS requirements. Refer to article in Accounting 101 series as a refresher about Financial reporting frameworks in Malaysia.

What is an asset?

An asset is one of the elements in financial statements. Other elements in the financial statements are liabilities, equity, income and expenses. These elements appear either in the statement of financial position or statements of profit or loss.

But what is an asset? From a technical perspective, an asset is “a present economic resources controlled by the entity as a result of the past events. An economic resource is a right that has the potential to produce economic benefits.” Simplifying it in layman’s terms, an asset is anything that you have the right over it, in control of it, and can benefit from it. For example, if you purchase a car where you have the right over it (for instance, the car is registered under your name), can control and decide how to utilise and benefit out of it – it is your asset. In another extreme example, you have an employee with a specific skill that is relevant to your company and you can benefit from his or her skill. However, as you don’t have the right and can’t force this worker to work for you (i.e., the employee is free to leave at any time), you don’t recognise this worker or his/her specific skill as your asset. This is regardless of whether the employee is currently serving or working for you. The three aspects must be met for an item to be classified as an asset. For accounting purposes, assets can be classified into two categories – financial assets and non-financial assets. They are explained further below.

What is a financial asset?

Financial asset is defined in MFRS 132 Financial Instruments: Presentation. In paragraph 11 of MFRS 132, a financial asset is defined as any asset that is:

- cash;

- an equity instrument of another entity;

- a contractual right:

- to receive cash or another financial asset from another entity; or

- to exchange financial assets or financial liabilities with another entity under conditions that are potentially favourable to the entity; or

- a contract that will or may be settled in the entity’s own equity instruments and is:

- a non-derivative for which the entity is or may be obliged to receive a variable number of the entity’s own equity instruments; or

- a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments, subject to certain exclusion.

An item that meets the above definition is classified as a financial asset. Otherwise, it will be classified as a non-financial asset. Financial assets are generally governed under MFRS 9 Financial Instruments with regard to its recognition, derecognition, and measurement. Financial asset is a financial instrument. This is because a financial instrument is defined as any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity. Accordingly, this article focuses on the accounting treatment for financial assets under MFRS 9. Some examples of financial assets are bank balances, deposits placements with financial institutions, receivables, loans and borrowings owing by other entities to your company, investments in other financial instruments such as investments in shares and bonds.

Recognition and classification of financial assets

Under MFRS 9, a financial asset is recognised when and only when the entity becomes a party to the contractual provisions of the instrument. On the day the entity becomes a party to the contractual provisions of the instrument, the entity is required to classify such financial asset either as:

- financial asset carried at amortised cost;

- financial asset carried at fair value through other comprehensive income; or

- financial asset carried at profit or loss.

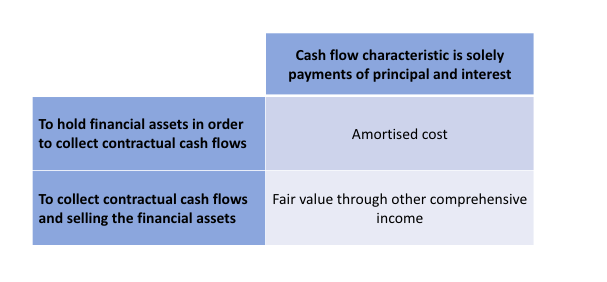

Different classification leads to different measurement of the financial assets in the financial statements – either at fair value or amortised cost. The classification reflects how the financial assets will be measured subsequently. However, the classification above is not a ‘free choice’ for an entity to choose from. There are certain rules surrounding each classification. Generally, the classification of a financial asset is determined based on the following two conditions:

- the business model for managing the financial assets – business model can either be (i) to hold the financial assets in order to collect contractual cash flows; (ii) to sell the financial asset, or (iii) both – holding and selling.

- the cash flow characteristics of the financial asset – whether cash flows of the financial assets are solely payments of principal and interest (commonly known as SPPI test) on the principal amount outstanding.

Financial assets that do not meet the conditions above are measured at fair value through profit or loss. Investments in equity instruments generally cannot meet the conditions above. Hence, such investment should be classified and measured as fair value at profit or loss. However, an exception is given for an entity to classify and measure its investment of particular equity instruments to present changes in fair value in other comprehensive income. This election, however, is irrevocable and can only be made on initial recognition of that investment. Take note that this election can only be made for investment in particular equity instruments – not investment in all equity instruments. This election can only be made for investment in equity instruments that are neither held for trading nor contingent consideration in a business combination in which MFRS 3 Business Combinations applies.

Can an entity reclassify its financial assets from one category to another? The answer to this is yes. However, reclassification of financial assets should only be made when and only when an entity changes its business model for managing the financial assets. In addition, there are certain rules governing the impact of such reclassification that entities will need to observe.

Measurement of financial assets

On initial recognition of financial assets, they should be measured at their fair value. However, for financial assets measured at fair value through other comprehensive income and amortised cost, the initial measurement must also include transaction costs that are directly attributable to the acquisition of the financial assets.

Subsequent measurement for financial assets follows their classification. For financial assets measured at amortised cost, the amount reflected in the statement of financial position reflects the carrying amount of the financial assets, after being adjusted for principal repayments, cumulative amortisation of interest and loss allowance (impairment). Interest revenue from financial assets measured at amortised cost is calculated using the effective interest method. What is an effective interest method? This method is essentially allocating or distributing the interest revenue in profit or loss over the period of the asset. Accordingly, the profit or loss reflects constant and stable interest revenue over the period.

For financial assets measured at fair value – either through other comprehensive income or profit or loss – the subsequent measurement of the financial asset is based on its fair value as at the reporting date. The difference between the two categories is where the fair value changes will be presented to reflect the financial performance. One is recognised in profit or loss while another one is recognised in other comprehensive income and will only be reclassified to profit or loss on derecognition. Fair value measurement of a financial asset is governed under MFRS 13 Fair Value Measurement.

Financial assets measured at amortised cost and financial assets measured at fair value through other comprehensive income are also subject to impairment. Under MFRS 9, the impairment of a financial asset is based on the expected credit loss model. The explanation of the expected credit loss model is available at Forward looking information for expected credit loss: Common macro economic factors considered by the Malaysian listed companies. The expected credit loss model emphasises that all financial assets have the chance to turn bad and entities are required to assess this chance/probability. There are two approaches for the expected credit loss model – (i) the general approach; and (ii) the simplified approach. Under the general approach, entities have to assess whether the loss/impairment allowance is based on 12-month expected credit losses or lifetime credit losses, depending on the credit risk of the financial assets. Under the simplified approach, however, impairment allowance is always measured at an amount equal to the lifetime expected credit losses. However, the simplified approach of measuring expected credit losses can only be used for certain limited financial assets, not all financial assets.

De-recognition of financial assets

Financial assets are also subject to de-recognition. What is de-recognition? Simply said, it is the process of taking out or excluding the financial asset from the book or financial statements. Financial assets should only be de-recognised when:

- the contractual rights to the cash flows from the financial asset expire; or

- an entity transfers the financial assets and such transfer qualifies for de-recognition.

Financial assets and their financial performance

An entity holds financial assets to either earn income (interest, dividend) or from the appreciation of its value. In certain situations, holding to a financial asset may also lead to an entity incurring expenses or losses. These income, gain, expenses and losses arising from the financial assets are also recognised or give effect to the movement in the financial performance of the entity. The common income, gain, expenses and losses arising from financial assets are:

- interest income

- fair value gain of the financial asset

- impairment loss or expenses (loss allowance)

- write off of the financial asset

- fair value loss of the financial asset.

We will further discuss non-financial assets in our next article. Unlike financial assets which are generally governed by MFRS 9, multiple standards govern the accounting for non-financial assets, depending on the nature of the assets. But don’t worry, we will help you to understand them further. Till then, don’t forget to checkout our Accounting 101 series for Beginners.