In our previous series of articles on Beginner’s guide on Accounting – Accounting 101, we have shared with you the objectives and the users of the general purpose financial statements. We have also explained the components of the general purpose financial statements. For this round, we will share with you the considerations for presentation of the financial statements – what are the things that preparers factored in when preparing the financial statements. We, however, will focus on the International Financial Reporting Standards (“IFRS”) framework as many preparers are using this framework. IFRS framework is equivalent to the Malaysian Financial Reporting Standards (“MFRS”) framework, so the requirements in the IFRS are also applicable to MFRS preparers.

Presentation of the financial statements

For entities using IFRS Framework, IAS 1 Presentation of Financial Statements (MFRS 101 equivalent) governs the principles of the presentation of financial statements. Why do preparers need this standard to govern the presentation of financial statements? Just imagine. There are millions of entities preparing their financial statements with millions of managements having their own preference and ways of presenting the financial statements. In addition, presentation of the financial statements may also be different from one year to another. IAS 1 aims to establish the principles that entities should follow to ensure the presentation of financial statements are consistent from one entity to another and from one year to another. Simply said – to ensure the comparability objective is met.

So, what are the principles covered by this standard? Here, the principles are grouped into 4 components:

- A complete set of financial statements

- The general features of financial statements

- The structure and contents of financial statements

- Other disclosures.

This article will cover the discussion on a complete set of financial statements as well as the general features of financial statements.

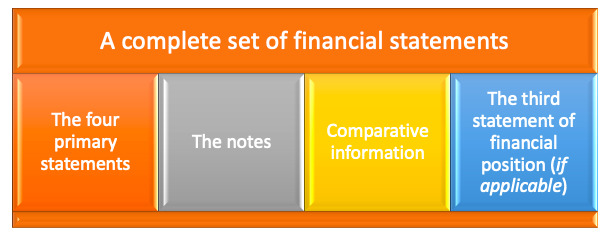

A complete set of financial statements

What does it mean by “a complete set of financial statements”? IAS 1 states that a complete set of financial statements consist of the following:

- The four primary statements – a statement of financial position as at the end of the period, a statement of profit or loss and other comprehensive income for the period, a statement of changes in equity for the period, and a statement of cash flows for the period;

- The notes – which must comprise the significant accounting policies and other explanatory notes;

- The comparative information of the preceding period; and

- A statement of financial position as at the beginning of the preceding period (if applicable).

The four primary statements and notes to the financial statements have been explained in great detail in our previous article . You can refer to the components of the general purpose financial statements for a refresher of these items.

Comparative information must be included in the financial statements. Comparative information allows users of the financial statements to compare the financial position, the financial performance and the cash flows movement of the entity in the current and previous year or period. These are useful information for users to understand how the entity has performed or progressed as compared to the last year or period. As the general principle, comparative information must be included in the primary statements as well as in the notes. However, there are certain standards which specifically do not require comparative information to be presented for certain notes. For example, paragraph 84 of IAS 37 Provisions, Contingent Liabilities and Contingent Assets does not require an entity to disclose the comparative information on the movement in the provision account.

The third statement of financial position – i.e. the statement of financial position as at the beginning of the preceding period – is required to be presented. This third statement of financial position should only be presented under 3 scenarios – (1) when applying accounting policy retrospectively, (2) to make retrospective restatement of items in the financial statements; or (3) when reclassifies items in the financial statements. The third statement of financial position shall be presented if any of the three scenarios has a material effect on the information in the statement of financial position at the beginning of the preceding period. Otherwise, the third statement of financial position does not need to be presented. The notes on the third statement of financial position are, however, not required to be prepared (paragraph 40C of IAS 1).

The general features of financial statements

This component deals with various features or aspects regarding the presentation of financial statements that an entity must comply with. They are:

1. Fair presentation and compliance with IFRS

Generally, the financial statements prepared by entities shall present a fair presentation of the financial position, financial performance and cash flows of the entity. Fair representation means the financial statements must faithfully represent the effect of transactions and events which had taken place, including:

- Selecting and applying appropriate accounting policies in the absence of an IFRS that specifically applies to an item.

- To present information so that they provide relevant, comparable and understandable information.

- To provide additional disclosures when the current disclosure requirements in IFRSs are insufficient to enable users to understand the impact of transactions or events.

IAS 1 also requires an entity to make an explicit and unreserved statement if the financial statements have been prepared in compliance with IFRSs. In the event that an entity does not comply with a requirement in an IFRS (which normally happens in extremely rare circumstances), an entity is required to make certain disclosures in the financial statements so that users are aware of the departure and the financial effect arising from the departure. Additional disclosures are also required if an entity thinks compliance with IFRS would be so misleading but at the same time is prohibited by the regulatory framework to depart from IFRS.

2. Going concern

The financial statements are prepared based on the going concern basis – i.e. the entity will continue the business for a foreseeable future. When management intends to liquidate the entity or cease its operation, the financial statements should not be prepared on a going concern basis. Instead, another basis of preparation will be used such as a break-up basis. So, whenever the financial statements are not prepared on a going concern basis, such facts, including the basis and reasons must be disclosed in the financial statements.

3. Accrual basis of accounting

Financial statements under IFRS are prepared under the accrual basis of accounting – except for the statement of cash flows. To learn about the accrual basis of accounting, you can refer to Introduction to Accounting .

4. Materiality and aggregation

This principle deals with combining items in the financial statements. It deals with questions, for example: ‘can I combine an item with another item in the statement of financial position?’ or ‘can I lump this expense with another expense in the profit or loss statement?’. The general principle in IAS 1 clearly states that an entity must:

- Present separately each material class of similar items. Material items should not be combined even if they are similar in nature.

- Present separately items of a dissimilar nature and function. This means items with dissimilar nature and function should not be combined together – unless if they are immaterial.

This principle must be applied with regard to the presentation of items in the primary statements or in the notes.

5. Offsetting

This principle deals with the question of whether an entity can offset assets and liabilities or income and expenses. IAS 1 prohibits an entity to offset assets and liabilities or income and expenses in the financial statements unless required or permitted by an IFRS.

6. Frequency of reporting

With regard to the frequency of reporting, IAS 1 requires an entity to present the complete set of financial statements at least annually.

7. Comparative information

Under IAS 1, an entity is required to present comparative information for all amounts reported in the current period’s financial statements, except when IFRS permit or require otherwise. Because of this, an entity shall present, at a minimum:

- Two statements of financial position;

- Two statements of profit or loss;

- Two statements of cash flows;

- Two statements of changes in equity; and

- Related notes.

Can an entity present more comparative information? For example, a statement of profit or loss for one additional comparative period. The answer to this is yes, but such information must also be prepared in accordance with IFRS. Interestingly, for this additional comparative information, it need not comprise a complete set of financial statements (i.e. an entity doesn’t need to prepare all four primary statements) and only present notes related to those additional statement(s) prepared.

8. Consistency of presentation

In principle, an entity is expected to retain the presentation and classification of items in the financial statements from one period to the next, except if:

- Another presentation or classification would be more appropriate, taking into consideration the criteria for the selection and application of accounting policies in IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. This can happen perhaps from a significant change in the nature of the entity’s operation or a review of its financial statements.

- An IFRS requires a change in presentation.

Now you already have the idea on what constitutes a complete set of financial statements as well as the general features of financial statements. In our next article, we will share with you the remaining two components – the structure and contents of the financial statements as well as other disclosure requirements.