In this article, we discuss on how to determine which MFRS standard to account for transactions or events. To account for any particular transaction or event, the first question to ask is – which accounting standard does the transaction or event fall into. Selecting the inappropriate standard leads to inappropriate treatment in terms of the recognition, measurement, and presentation/disclosure in the financial statements. Accordingly, it is crucial to get this consideration right.

Of course, there are a lot more transactions or events in practice that fall under the grey area. This means there is no clear cut answer on which accounting standard to apply. In such a case, an entity needs to apply judgements to determine the appropriate standard to account them.

MFRS accounting standards

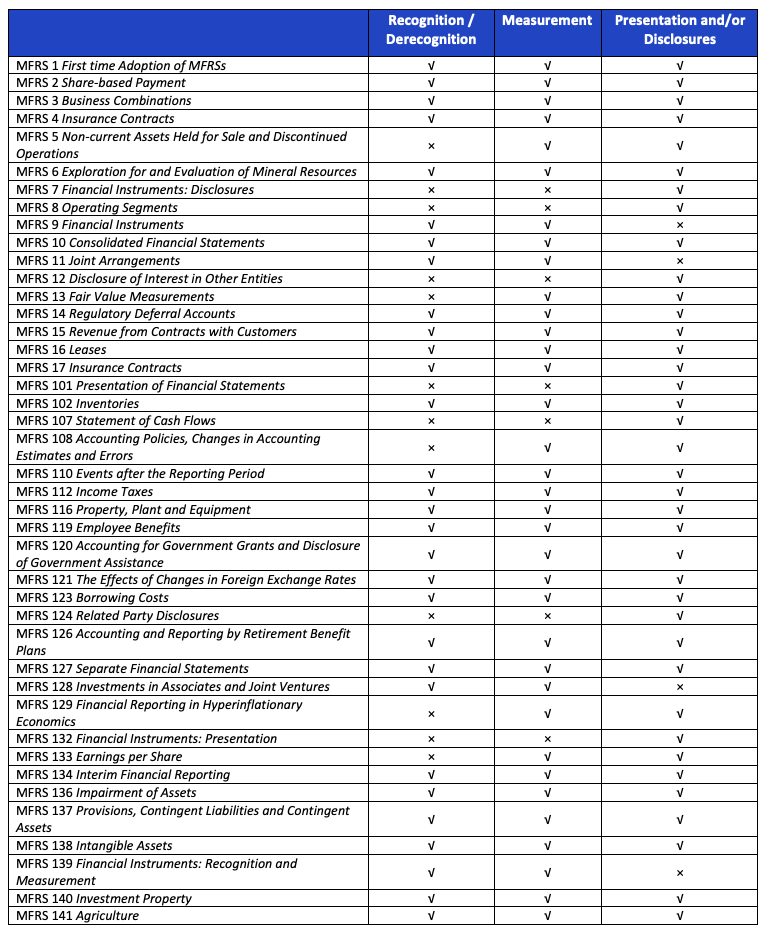

Under the MFRS framework, there are 42 standards currently in use. They cover various aspects – recognition/derecognition, measurement, or presentation and disclosure. We summarise them in the table below:

Take note that some standards cover specifically the measurement and/or presentation and disclosure. While some others cover specific transactions or events.

The standards that cover specific transactions or items generally comprise 3 aspects – recognition/derecognition, measurement and presentation. For example, MFRS 2, MFRS 102, MFRS 116 and MFRS 138.

MFRS 101 is the “mother” of presentation requirements. This is because it governs the overall guiding principles on presentation of transactions or events as well as presentation of financial statements as a whole.

Determining MFRS standard that is applicable for a transaction or event

When we talk about determining which standard is applicable for a transaction, we are talking about scoping of the transaction. Although a transaction is accounted for under a particular standard, its measurement and presentation/disclosure may be subjected to the requirements of other standards.

For example, an entity measure its investment property using the fair value model under MFRS 140 Investment Property. However, the fair value measurement is guided under MFRS 13 Fair Value Measurement. Such investment property is also subject to the disclosure requirements in MFRS 13.

The scoping

The following are the questions that an entity may need to ask to determine the appropriate standard for a particular transaction or event:

- Does the transaction meet the definition of a particular standard? For example, an entity acquired an office building. An entity will then assess whether the office building acquired meets the definition of MFRS 116 or MFRS 140.

- Does the scope section of the standard exclude the transaction that an entity is looking at? For example, an entity acquires interest in a subsidiary. Although interest in the subsidiary is a financial instrument, MFRS 9 Financial Instruments scopes out interest in the subsidiary from this standard. Hence, an entity accounts for such interest according to MFRS 10 Consolidated Financial Statements or MFRS 127 Separate Financial Statements.

The scoping section of a particular standard may:

- Excludes the transaction or event entirely from the standard. For example, MFRS 102 Inventories excludes biological assets related to agricultural activity. Instead biological assets related to agricultural activity is subject to MFRS 141 Agriculture.

- Includes certain elements of a transaction or event in the standard. For example, the derecognition and impairment for finance lease receivables and operating lease receivables by the lessor are subject to the requirements of MFRS 9 Financial Instruments although MFRS 16 Leases applies to lease transactions.

Developing an accounting policy for a transaction or event

What if none of the MFRS standards address the transaction or event that an entity is looking at? In this situation, an entity will need to use its judgments to develop an accounting policy. The accounting policy developed must be relevant and reliable for such transactions or events.

Next question then is how an entity develop the accounting policy? In developing such an accounting policy, an entity uses the hierarchy under MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors. They are as follows:

- First, the requirements in MFRSs dealing with similar and related issues as the transactions or events.

- Secondly, the definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in the Conceptual Framework for Financial Reporting.

When developing an accounting policy for a transaction or event through analogy to an MFRS dealing with similar and related issues, the IFRS Interpretations Committee (“IFRIC”) clarifies IFRIC March 2011 Meeting Update that an entity must use its judgment in applying all aspects of the MFRS that are applicable to the issue instead of the particular aspect being analogous to.

We hope this article helps to explain on how an entity determines the MFRS standard to account for a transaction or event in the financial statements.