Employees are crucial assets of any businesses and because of this, we bring to you the accounting for employee benefits. Undoubtedly, costs of employee benefits are among the significant costs in the financial statements. This depends on number of employees, how good entities pay their employees and types of benefits provided to them.

IAS 19 Employee Benefits stipulates the financial reporting requirements relating to employee benefits. Among others, the standard governs the recognition of liability when an employee has provided service and recognition of an expense when an entity consumes the economic benefit arising from services provided by an employee.

The standard covers the accounting for all employee benefits. However, it does not cover the accounting for employee benefits where IFRS 2 Share-based Payment applies. We will cover discussion on IFRS 2 in our future article.

Let’s now go into the details on how entities account for employee benefits.

What are employee benefits?

Employee benefits refer to all form of consideration given by an entity in exchange for service rendered by employees. For this, there are four types of employee benefits:

- First, short-term benefits. If an entity expect to settle the benefits wholly before 12 months after the end of the annual reporting period, the entity classfies them as short-term benefits.

- Second, post employment benefits such as retirement benefits. Post employment benefits are benefits payable after completion of employment.

- Third, other long-term employee benefits. For example, long-term disability benefits, long-term paid absences.

- Lastly, termination benefits. This is the benefits provided in exchange for the termination of an employee’s employment.

To further clarify, employee benefits include benefits provided and may be settled by payments made either to the employees or their dependents or beneficiaries.

Accounting for short-term employee benefits

Short-term employee benefits include:

- wages, salaries and social security contributions;

- paid annual leave and paid sick leave;

- profit sharing and bonuses; and

- non-monetary benefits for current employees such as medical care, housing, cars and free or subsidised goods or services.

Short-term employee benefits are common to most entities.

The general principles for all short-term employee benefits

Entities recognise the amount of benefits expected to be paid in exchange for the services rendered by employees during an accounting period. The amount recognised do not need to be discounted for time-value of money (i.e. undiscounted amount of employee benefits).

In particular, entities recognise the amount:

- As a liability, i.e. as accrued expenses, net of any amount already paid. However, if the amount paid exceeds the amount of benefits, entities recognise the excess as an asset. Entities recognise an asset to the extent it leads to a reduction in future payments or a cash refund.

- As an expense in profit or loss unless another IFRSs allows or requires inclusion of the amount in the cost of an asset.

Short-term paid absences

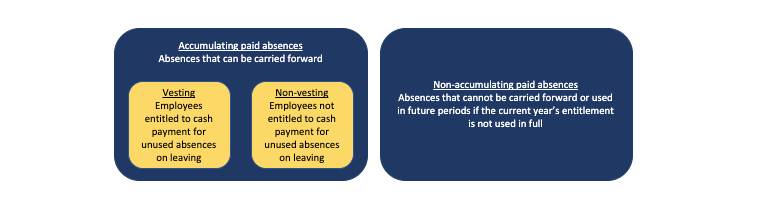

IAS 19 provides the requirements on when should entities measure the expected cost for paid absences. For this, the recognition depends whether the paid absences are accumulating paid absences.

- Accumulating paid absences – entities measure the expected cost when employees render service that increases their entitlement to future paid absences.

- Non-accumulating paid absences – entities measure the expected cost when the absences occur.

Entities consider paid absence as “accumulating” if employees can carry forward the absence and use it in future periods. An accumulating paid absence is further segregated into vesting or non-vesting.

An obligation exists for accumulating paid absence. Accordingly, an entity recognises such obligation as employees render service that increases their entitlement to future paid absences. IAS 19 requires entities to measure the expected cost of accumulating paid absences as the additional amount that the entity expects to pay as a result of the unused entitlement that has accumulated at the end of the reporting period. This is solely from the fact that the benefit accumulates.

Profit-sharing and bonus plans

Entities recognise the expected costs for profit-sharing and bonus plans when and only when:

- Firstly, when the entity has a present obligation to make the payment as a result of past event; and

- Secondly, when entities can make a reliable estimate of the obligation.

The present obligation can either be legal or constructive obligation. In addition, such obligation exist when and only when the entity has no realistic alternative but to make the payments.

To clarify, entities can make a reliable estimate when and only when:

- The formal terms of the plan contain a formula for determining the amount of the benefit;

- The entities determine the amounts to be paid before the financial statements are authorised for issue; or

- Past practice gives clear evidence of the amount of the entity’s constructive obligation.

Accounting for post-employment benefits

Post-employment benefit plans are classified as either defined contribution plans or defined benefit plans. The classification depends on the economic substance of the plan based on its principal terms and conditions.

| Defined contribution plans | Defined benefit plans |

|---|---|

| Benefit plan where an entity pays fixed contribution into a separate entity and will have no legal or constructive obligation to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits relating to employee service in the current and prior periods. | Benefit plans other than defined contribution plans. |

Defined contribution plans

An example of defined contribution plans in Malaysia is Employee Provident Fund (“EPF”). Under this plan, the amount of the post-employment benefits received by the employee is determined by the amount of contributions paid by an entity to the plan together with investment returns arising from the contributions.

Because of that, the recognition and measurement for defined contribution plans is straight-forward. Entities recognise the contribution payable to the plan when employees have given services to the entities. The recognition principles for the contribution payable is similar to the general principles for short-term employee benefits explained above.

However, if the contributions are not expected to be settled wholly before 12 months after the end of the annual reporting period in which the employees rendered the related service, the amount is discounted using a discount rate.

Defined benefit plans

As for defined benefit plans, entities’ obligations are to provide the agreed benefits to current and former employees. Consequently, entities are subject to actuarial risk – i.e. risk that the benefits will cost more than expected — and investment risk. This means, when actuarial or investment deteriorates than expected, entities’ obligations may be increased.

In the light of the actuarial risk that entities are exposed to, the accounting for defined benefit plan is rather complex. It requires the use of actuarial assumptions to measure the obligation and the expense. In addition, there is also possibility of actuarial gains and losses and involvement of discounting as the obligation may be settled many years after the employees render the related service.

The following are the steps to account for defined benefit plans.

- Firstly, an entity needs to determine the deficit ot suplus.

- Secondly, an entity needs to determine the amount of the net defined benefit liability or asset.

- Thirdly, an entity determines the amount to be recognised in profit or loss.

- Lastly, an entity determines the remeasurements of the net defined benefit liability or asset.

We will cover the detailed discussion on how to account for defined benefit plans in our next article. This is only relevant for entities that provide defined benefit plans to their employees. If your company does not offer this plan, you can totally ignore this part.

Insured benefits

Some entities may also pay insurance premiums to fund a post-employment benefit plans. In such a situation, entities treat such a plan as a defined contribution plan unless they have a legal or constructive obligation, directly or indirectly, either:

- To pay the employee benefits directly when they fall due; or

- To pay further amounts if the insurer does not pay all future employee benefits relating to employee service in the current and prior periods.

Accounting for other long-term employee benefits

The measurement of other long-term employee benefits is not usually subject to the same degree of uncertainty as the measurement of post-employment benefits. As such, IAS 19 requires a simplified method to account for other long-term employee benefits. Specifically, this method does not recognise remeasurements in other comprehensive income.

For the recognition and measurement of surplus and deficit, entities will apply the same requirements as post-employment benefits, which will be covered in the next article. Entities recognise the net total of the following in profit or loss, unless another IFRSs requires or allows their inclusion in the cost of an asset:

- First, service cost.

- Secondly, net interest on the net defined benefit liability or asset.

- Lastly, remeasurement of the net defined benefit liability or asset.

Any reimbursement right relating to other long-term employee benefits is treated the same as reimbursement right for post-employment benefits.

Accounting for termination benefits

IAS 19 separates the accounting for termination benefit from other employee benefits. This is because the event that give rise to the obligation is the termination of employee instead of employee service. Termination benefits result from:

- First, an entity’s decision to terminate the employment.

- Secondly, an employee’s decision to accept an entity’s offer or benefits in exchange for termination of employment.

Termination benefits do not include employee benefits arising from termination at the request of the employee, without an entity’s offer. In addition, termination benefits also do not include termination as a result of mandatory retirement requirements. This is because such benefit is treated as post-employement benefits.

Next question is what if an entity provides some benefits for termination of employment at the request of an employee? In such a situation, the difference between the benefit provided for termination at the request of employee and benefit provided at the request of the entity is a termination benefit. This is because the benefit is in substance a post-employment benefit.

Recognition and measurement of termination benefits

So, how does an entity recognise and measure termination benefits?

| Recognition of termination benefits | Measurement of termination benefits |

|---|---|

| Entities recognise liabilities and expenses for termination benefits at the earlier of the following: – The date when the entities can no longer withdraw the offer of the benefits. – The date when the entities recognise costs for restructurings that are within the scope of IAS 37 Provisions, Contingent Liabilities and Contingent Assets which involve the payment of termination benefits. | In general, entities measure termination benefits on initial recognition and subsequent changes in accordance with the nature of the benefits – i.e. either similar to short-term benefits or other long-term benefits. However, if the benefits are an enhancement to post-employment benefits, entities apply the requirements for post employment benefits. |

This now concludes the summary of employee benefits in IAS 19. We however, have not discussed in detail the principles to account for defined benefit plans. We will cover this in the next article. If you do not want to miss this article, head out to subscribe to our newsletter. Meantime, enjoy other articles in the Financial Accounting Section.