MPSAS 27, MFRS 141 and Section 34 of MPERS provide the requirements on how entities account and presents information related to agricultural activity in the financial statements. This time, we compare the financial accounting requirements for agriculture between the three standards.

The three standards define agricultural activity consistently as the management by an entity of the biological transformation of biological assets for sale or conversion into agricultural produce or additional biological assets. MPSAS 27 additionally states that the standard also governs the biological assets for distribution at no charge or for a nominal charge. This concept is applicable for public sector entities due to their roles and responsibility as explained in Why There is a Need for Public Sector Accounting Standards.

Now, let us understand other differences in the financial reporting requirements.

Scope of agriculture

MPSAS 27 applies to biological assets and agricultural produce at the point of harvest. MFRS 141 has a similar scoping requirement except that it does not apply to bearer plants. Bearer plant is a living plant that:

- Firstly, is used in the production or supply of agricultural produce;

- Secondly, is expected to bear produce for more than one period; and

- Lastly, has a remote likelihood of being sold as agricultural produce, except for incidental scrap sales.

Entities account for bearer plants under MFRS 116 Property, Plant and Equipment.

The requirement to account for bearer plants separately is not applicable in MPSAS 27. In fact, the concept of bearer plant is not in MPSAS literature. Accordingly, entities account for biological assets as a whole as per the requirements in MPSAS 27. Section 34 of MPERS also has a similar requirement to MPSAS 27. Section 34 does not require entities to determine whether a biological asset is a bearer plant.

MPSAS 27 excludes the following from its scope:

- Land related to agricultural activity.

- Intangible assets related to agricultural activity.

- Biological assets held for the provision or supply of services.

MFRS 141 has similar requirements to MPSAS 27. However, MFRS 141 also excludes the following:

- Bearer plants related to agricultural activity.

- Government grants related to bearer plants.

- Right-of-use assets arising from a lease of land related to agricultural activity.

Section 34 of MPERS, on the other hand, does not have any specific scope exclusion.

Measurement of a biological asset or agricultural produce

Let’s now see the differences relating to the measurement of a biological asset or agricultural produce.

Fair value measurement

MPSAS 27 and MFRS 141 require entities to measure their biological assets at fair value on initial recognition and at each reporting date. Section 34 of MPERS also stipulates the same requirement to measure biological assets at fair value. However, Section 34 states that entities measure at fair value only for biological assets for which the fair value is readily determinable without undue cost or effort. For biological assets in which the fair value is not readily determinable without undue cost or effort, entities will need to use the cost model to measure the biological assets.

In comparison, MPSAS 27 and MFRS 141 include a rebuttable presumption. Both standards presume that entities can always measure the fair value of biological assets reliability. Entities can, however, rebut to this presumption. Entities can only rebut this presumption on the initial recognition of a biological asset. The presumption can be rebutted only when the market-determined prices or value are not available and for which alternative estimates of fair value are clearly unreliable. This is high hurdle threshold to pass by entities in practice. In contrast, the undue cost or effort in Section 34 of MPERS provides a lower level threshold to pass than rebutting the presumption in MPSAS 27 and MFRS 141.

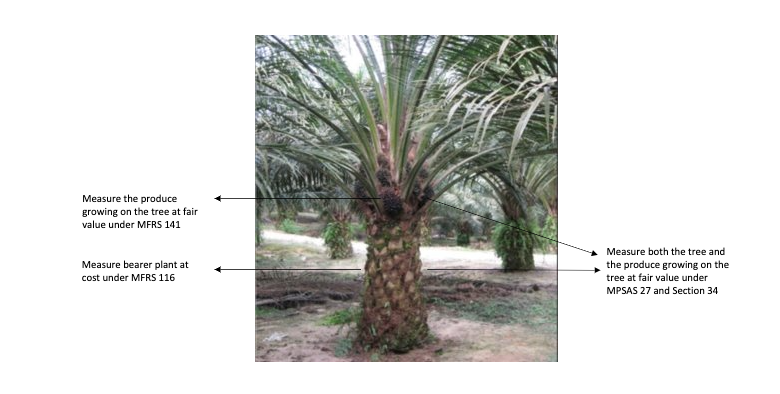

Splitting of bearer plant and produce growing on the trees

We mentioned earlier that MFRS 141 requires entities to split between a bearer plant and agricultural produce growing on it. This adds complexity to the accounting for entities applying MFRS. This concept is, however, not applicable on MPSAS 27 and Section 35. The picture below illustrates this financial accounting consideration.

In determining the fair value measurement, MPSAS 27 and Section 34 provide some guidance to preparers. This is not available in MFRS 141 as entities follow the guidance in MFRS 13 Fair Value Measurement to measure fair value. Unlike MFRS, MPSAS and MPERS do not have a specific standard or section governing fair value measurement. Hence, the respective standards include the specific guidance on fair value measurement.

Government grants

MFRS 141 also provides financial reporting requirements in relation to government grants related to biological assets. Particularly on how entities should recognise the grant in profit or loss. The requirements are not available in MPSAS 27 and Section 35 of MPERS.

Conclusion

The above sums up the significant differences in the financial reporting requirements relating to agriculture under MPSAS 27, MFRS 141 and Section 34 of MPERS. Take note that at the international level, the International Public Sector Accounting Standards Board (“IPSASB”) has issued a revised IPSAS 27 Agriculture. The revised is more aligned to the requirements in MFRS 141. The revised standard is available in the Handbook of International Public Sector Accounting Pronouncements.

We will continue to bring you a comparison for other standards in future articles. In the meantime, you can read other relevant articles in the Financial Accounting section.