It is common for entities to sell their assets or discontinued certain business operations. This can especially happen when the economy is slowing down. However, assets held for sale and discontinued operations can also took place for business reasons. For example, when a specific business operation or segment, not making profit, entities may decide to stop such operation.

In this article, we will look at the financial reporting requirements in relation this topic. IFRS 5 Non-Current Assets Held for Sale and Discontinued Operations governs the financial reporting requirements for assets held for sale and discontinued operations. In particular, the standard specifies the measurement, presentation and disclosure requirements.

However, the standard does not apply to the measurement of the following assets:

- Deferred tax assets.

- Assets arising from employee benefits.

- Financial assets within the scope of IFRS 9 Financial Instruments.

- Investment property measured using the fair value model.

- Non-current assets measured at fair value less costs to sell in IAS 41 Agriculture.

- Contractual rights under insurance contracts

Let us now go into the details.

When do we classify a non-current asset as held for sale?

An entity recovers an asset’s carrying amount either through its sale or continuing use. Entities classify an asset as held for sale when the recoverability of the carrying amount is principally through a sale rather than through its continuing use. An entity also applies the same principle for a disposal group.

But what is a disposal group? IFRS 5 defines a disposal group as a group of assets to be disposed of, by sale or otherwise, together as a group in a single transaction. In fact, entities must also consider the liabilities directly associated with those assets in the disposal group.

While entity expects the recoverability of the asset’s carrying amount is through sale, there are conditions before such classification. IFRS 5 emphasise that such asset or disposal groups must be available for immediate sale in its present condition. In particular, the sale of the asset is only subject to usual and customary terms. It is also important to note that the sale must also be highly probable.

How do we know if the sale is highly probable?

A sale is highly probable when it meets the following conditions:

- Firstly, there is a commitment from an appropriate level of management to the plan to sell the asset.

- Secondly, the entity has started an active programme to find the buyer and complete the plan.

- Thirdly, there is an active effort to market the asset for sale at a price that is reasonable in relation to its current fair value.

- Fourthly, the capability of the sale to complete within one year from the date of classification.

- Lastly, significant changes to the plan or withdrawal of the plan is unlikely.

Nevertheless, IFRS 5 acknowledges that there are circumstances that may extend the period to complete the sale beyond one year. For example, where the sale requires approval from different authorities. The classification of an asset as held for sale is still appropriate provided that the circumstances that cause the extension are beyond the entity’s control. Importantly, the entity must remain committed to its plan to sell the asset.

What happen when a non-current asset (or disposal group) is classified as held for sale?

When an entity classifies an asset as held for sale, the entity measures the asset at the lower of its carrying amount and fair value less costs to sell. The entity measures the asset’s carrying amount in accordance with applicable IFRSs right before its initial classification as held for sale.

Entities must present assets held for sale separately from other assets. Same goes to liabilities of a disposal group classified as held for sale. The standard does not allow offsetting of assets and liabilities in a disposal group. As such, no presentation of assets and liabilities as a single amount.

If an entity expects the sale to occur beyond one year, it needs to account for the costs to sell at its present value. Entities present the movement from the present value as a financing cost. In addition, entities will not depreciate or amortise an asset while it is classified as held for sale.

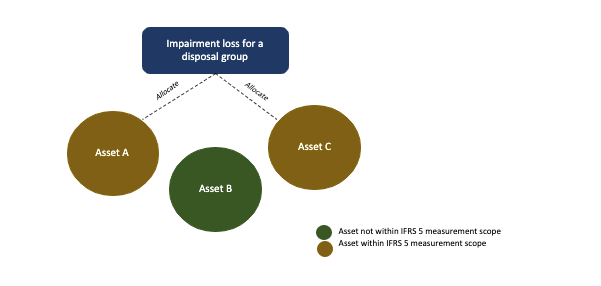

An entity writes down the carrying amount of an asset to its fair value less costs to sell as an impairment loss. For a disposal group, the impairment loss reduces the carrying amount of assets in the group that are within the scope of measurement.

For this, an entity distributes the impairment loss to those assets using the same allocation for a cash-generating unit. A quick look at What is Impairment of Asset in IAS 36 will help you to understand the allocation basis.

What if there is a gain from subsequent increase in fair value less costs to sell? Entities recognise such gain to the extent of the cumulative impairment loss that has been recognised for the asset either based on this standard or IAS 36 Impairment of Assets.

Should entities classify an asset as held for sale if it expects to abandon the asset?

In this case, entities should not classify asset to be abandoned as held for sale. Why is this the case? Although entities expect to abandon the asset, the recovery of the carrying amount is still through continuing use instead of sale. Hence, held for sale classification is not appropriate.

Nevertheless, if a disposal group constitutes a discontinued operation, entities present the operation’s results and cash flows separately from continuing operation at the date when operation ceased.

What happen when an asset no longer meets the criteria as held for sale?

It is also possible for an entity to change its plan to sell an asset (or disposal group). In such a situation, IFRS 5 requires an entity to stop classifying the asset as held for sale. Additionally, when the criteria above are no longer met, entities also cease the held for sale classification.

When an asset or a disposal group no longer met the held for sale classification, entities measure the asset at the lower of:

- The carrying amount before the asset was classified as held for sale. Entities adjust for any depreciation, amortisation or revaluation that would have been recognised had the asset not been classified as held for sale.

- Its recoverable amount at the date of the subsequent decision not to sell.

What is a discontinued operation?

IFRS 5 defines a discontinued operation as a component of an entity that either has been disposed of or is classified as held for sale. A discontinued operation is either:

- First, represents a separate major line of business or geographical area of operation.

- Secondly, is part of a single co-ordinated plan to dispose of a separate major line of business or geographical area of operations.

- Or lastly, is an acquired subsidiary exclusively with a view to resale.

A component of an entity comprises operations and cash flows that can be clearly distinguished, operationally and for financial reporting purposes.

What happen when an entity discontinues an operation?

Unlike an asset held for sale, IFRS 5 does not require a separate measurement principle for a discontinued operation. However, IFRS 5 requires a separate presentation for a discontinued operation from the continuing operation. Additionally, when an entity classifies an operation as a discontinued operation, the entity need to re-present the disclosures for prior period relating to the operation.

To summarise the above, entities apply different measurement principle for assets held for sale. The classification of an operation as a discontinued operation does not change its measurement. But entities will need to observe significant disclosure and presentation requirements including re-presentation of prior period financial information.

We will continue our discussion on other financial reporting requirements in our future articles. Meantime, enjoy other articles in the Financial Accounting Section.