In this article, we continue to discuss on the financial accounting requirements for business combinations in IFRS 3. This article is a continuation from Part I discussion on business combinations.

In Part I, we have shared with readers on what is business combinations and its key principles. If you missed it or would like to refresh your understanding on the principles of business combinations, head out to Accounting for business combinations in IFRS 3 (Part I).

Let us now understand how an entity account for a business combination.

The acquisition method

IFRS 3 requires entities to account for each business combination using the acquisition method. In applying the acquisition method, entities must:

- Firstly, identify the acquirer.

- Secondly, determine the acquisition date.

- Thirdly, recognise and measure the identifiable assets acquired, the liabilities assumed and any non-controlling interest (“NCI”) in the acquiree.

- Lastly, recognise and measure goodwill or a gain from a bargain purchase.

These are the four steps to account for a business combination.

#1: Identifying the acquirer

An acquirer is the entity that obtains control of another entity – i.e., the acquiree. In determining whether an entity obtains control of another entity, entities apply the control guidance in IFRS 10 Consolidated Financial Statements. We have covered discussion on control determination in Key Principles in the Preparation of Consolidated Financial Statements in IFRS 10.

In certain business combinations, determining the acquirer is not so clear even after applying the guidance in IFRS 10. In such a situation, entities consider the following factors in making the determination:

- The entity that transfer the cash or other assets or by incurring liabilities is usually the acquirer.

- The entity that issues its equity interests is generally the acquirer for business combination effected primarily by exchanging equity interest, except in reverse acquisition.

- The acquirer is usually the combining entity whose relative size is significantly greater than that of the other combining entity.

- The combining entity that initiated the combination and the relative size of the combining entity.

- If a new entity is formed to issue equity interests to effect a business combination, one of the combining entities that existed before the business combination is the acquirer.

#2: Determining the acquisition date

The acquisition date is the date on which the acquirer obtains control of the acquiree. The date is generally the date on which the acquirer legally transfers the consideration, acquires the assets and assume the liability of the acquiree (“the closing date”).

However, there are certain circumstances where the acquirer obtains control either earlier or later than the closing date. For example when the written agreement provides the acquirer with the control of the invested on a date before the closing date.

#3: Recognising and measuring the identifiable assets acquired and liabilities assumed and NCI

Let’s understand how acquirer recognise and measure the identifiable assets, liabilities and non-controlling interests.

The recognition

The general principle is an acquirer is required to recognise the identifiable assets acquired, the liabilities assumed and any NCI in the acquiree, separately from goodwill on the acquisition date. The recognition of identifiable assets and liabilities assumed is subject to the following conditions:

- Meeting the definition of assets and liabilities – The identifiable assets acquired and liabilities asssumed must meet the definition of assets and liabilities in the Conceptual Framework for Financial Reporting.

- Part of the business combination transaction – The identifiable assets acquired and liabilities assumed must be part of what the acquirer and the acquiree (the former owner(s)) exchanged in the business combination transaction rather than the result of separate transactions.

The assets acquired and liabilities assumed will then need to be classified or designated on the basis of the contractual terms, economic conditions, its operating or accounting policies and other crucial conditions exist at the acquisition date. This principle is not applicable for classification of a lease contract in which the acquirer is the lessor and classification of contract as an insurance contract.

The measurement

Next question is how does an acquirer measure the identifiable assets acquired and the liabilities assumed? IFRS 3 requires entities to measure them at their acquisition-date fair value.

How about NCI then? How should an acquirer measure NCI? The component of NCIs that present ownership interests and entitle their holders to a proportionate share of the entity’s net assets in the event of liquidation is measured at either

- fair value; or

- the present ownership instruments’ proportionate share in the recognised amount of the acquiree’s identifiable net assets.

All other components of NCI are measured at their acquisition-date fair values, unless other mesurement basis is required by International Financial Reporting Standards (“IFRSs”).

IFRS 3 also provides limited exceptions to the recognition and measurement principles. They are as follows:

| Exception to the recognition principle | Exceptions to both the recognition and measurement principles | Exceptions to the measurement principle |

|---|---|---|

| Contingent liabilities | – Income taxes – Employee benefits – Indemnification assets – Leases in which the acquiree is the lessee | – Reacquired rights – Share-based payment transactions – Assets held for sale |

#4: Recognising and measuring goodwill or a gain from a bargain purchase

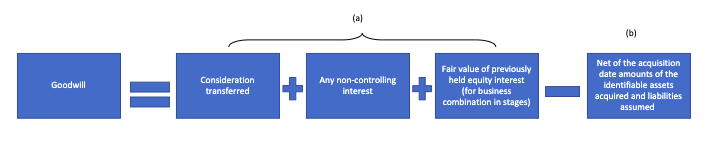

IFRS 3 requires an acquirer to recognise goodwill as of the acquisition date, measured as follows:

A bargain purchase is a situation whereby in the business combination, (b) exceeds (a). This can happen in a business combinations that is a forced sale (the seller is acting under compulsion).

It is important for entities to first re-assess whether it has correctly identified all of the assets acquired and all of the liabilities assumed as well as any additional assets or liabilities before recognising a gain on bargain purchase. This is to ensure that the measurements appropriately reflect consideration of all available information as of the acquisition date. It is also important to remind that an acquirer should recognise the acquisition-date fair value of contingent consideration as part of the consideration transferred.

Other financial reporting considerations for business combinations

The following are other considerations relating to the financial reporting requirements on business combinations.

The provisional period

A business combination can take substantial period of time to complete. This could means that the business combination is incomplete by the end of the reporting period. In such a situation, IFRS 3 allows an entity to report the provisional amounts for the items for which the accounting is incomplete. This period is known as “the measurement period”. It provides an acquirer the reasonable time to obtain the information necessary to identify and measure:

- the identified assets acquired, liabilities assumed and any NCI;

- the consideration transferred;

- the equity interest previously held in a business combination achieved in stages; and

- the resulting goodwill or gain on a bargain purchase.

During the measurement period, an acquirer adjusts the provisional amount retrospectively to reflect new information obtained. This measurement period however, should not be more than one year from the acquisition date. An increase or decrease in the provisional amount is affected by the increase or decrease in goodwill. After the measurement period has ended, revision to the accounting for business combination is made only to correct an error and accounted for in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

Subsequent measurement

After the initial recognition and measurement of a business combination, IFRS 3 requires an acquirer to subsequently measure and account for assets acquired, liabilities assumed or incurred and equity instruments issued in accordance with the relevant IFRSs for those items.

IFRS 3, however, provides specific guidance for subsequently measuring and accounting of the following items:

- Reacquired rights – A reacquired right recognised as intangible asset, entities amortise it over the remaining contractual period of the contract.

- Contingent liabilities – An acquirer measures the contingent liabilities at the higher of: (a) the amount that would be recognised in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets or (b) the amount initially recognised, until the liabilities are settled, cancelled or expires.

- Indemnification assets – Entities measure assets on the same basis as the indemnified liability or assets, subject to any contractual limitations on its amount, and for the indemnification asset that is not subsequently measured at fair value, management’s assessment of the collectibility of the indemnification asset.

- Contingent consideration — Changes in the fair value of contingent consideration that are not measurement period adjustments are accounted as:

- For those classified as equity – no remeasurement and entities account for the subsequent settlement within equity.

- Others – entities recognise changes in fair value in profit or loss.

Conclusion

Although to account for business combinations as the requirements above involve lots of judgments, we hope this article provides readers with the key principles on how to account for it.

We will bring you more technical discussion in our upcoming articles. Stay tuned for our upcoming articles by following us on social media. Meantime, enjoy other articles in Financial Accounting section or ask your queries by Joining on Community. It is free and open to join for all, now.