IFRS Interpretation Committee (“IFRIC”) had issued an agenda decision to summarise IFRIC consideration and decision relating to the disclosures and presentation of liabilities to pay for goods and services received under a reverse factoring arrangement. The agenda decision discusses and considers the presentation and disclosure requirements under the IAS 1 Presentation of Financial Statements, IAS 7 Statement of Cash Flows and IFRS 7 Financial Instruments: Disclosures from the buyer’s (or customer’s) perspective.

Let’s now go into the details of the issues.

What is Supply Chain Financing Arrangements – Reverse Factoring?

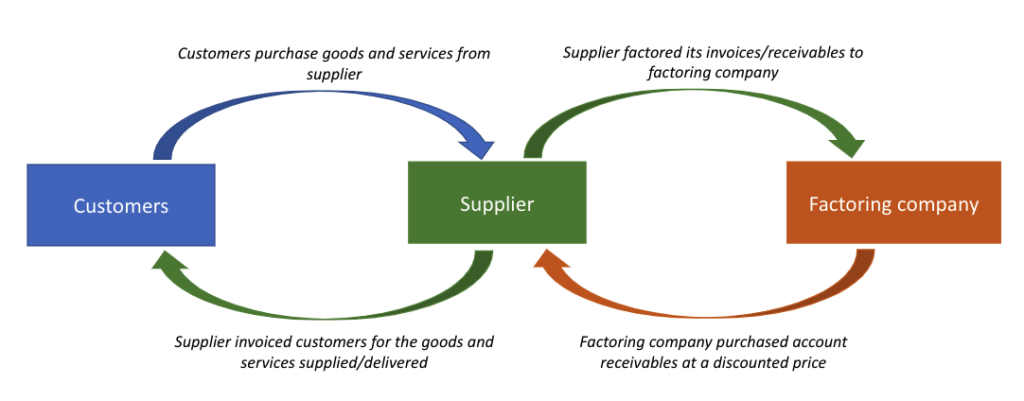

Under a normal factoring arrangement, a supplier who sells the goods or services sell its account receivables before the invoices are paid by customers. This allows the suppliers to obtain immediate cash without have to wait for the invoice due date. The account receivables are sold off to a factoring company at a discounted price. This arrangement is illustrated in the diagram below:

However, under a reverse factoring arrangement or also known as supply chain financing, the customers obtain or initiate the financing from financial institutions to finance their purchases from the supplier. Similar to normal factoring arrangement, the supplier will still get paid earlier than the invoiced payment date under the reverse factoring arrangement.

The questions submitted to IFRIC for the reverse factoring arrangement were :

- How does the customer (an entity) present liabilities that are part of a reverse factoring arrangement?

- What information about reverse factoring arrangements the entity is required to disclose in the financial statements?

What is the IFRIC view on Supply Chain Financing Arrangements – Reverse Factoring?

IFRIC discussed and deliberated the presentation and disclosure requirements for the supply chain financing arrangements as follows:

Presentation of the financial liability from the reverse factoring in the statement of financial position

An entity generally records and presents the financial liability arising from the purchases from the suppliers as ‘trade and other payables’ in the statement of financial position. ‘Trade and other payables’ is presented separately from other liabilities in the statement of financial positions due to their different nature or function. The question is then, how about financial liability arising from supply chain financing arrangement? Does it need to be presented separately, on its own in the statement of financial position? Or should it be presented within the ‘trade and other payables’? Or presented within ‘other financial liabilities’?

This question requires entities to fall back to the general principles in IAS 1 Presentation of Financial Statements as follows:

- An entity shall present separately each material class of similar items. An entity shall present separately items of a dissimilar nature or function unless they are immaterial.

- An entity shall present additional line items, headings and subtotals in the statement of financial position when such presentation is relevant to an understanding of the entity’s financial position.

Based on the guidance from IAS 1 above, IFRIC concluded that an entity presents liabilities that are part of the reverse factoring arrangements as follows:

- As part of ‘trade and other payables’ only when those liabilities have similar nature or function to trade payables.

- Separately when the size, nature or function of those liabilities makes separate presentations relevant to the understanding of the entity’s financial position. Entities shall also consider the amount, nature and timing of those liabilities to determine whether to present such liabilities separately, including whether disaggregation from ‘trade and other payables’ is necessary.

In this regard, IFRIC also concluded that an entity presents a financial liability as a ‘trade payable’ only when it:

- Represents a liability to pay for goods or services;

- Is invoiced or formally agreed with the supplier; and

- Is part of the working capital used in the entity’s normal operating cycle.

This is consistent with the definition of trade payables in paragraph 11 of IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

In this agenda decision, IFRIC also provided examples of factors to be considered by an entity to determine whether to present liabilities that are part of reverse factoring arrangements separately as follows:

- Additional security is provided as part of the arrangement that otherwise, would not be provided.

- The extent to which the terms of liabilities that are part of the arrangement differ from the terms of the entity’s trade payables that are not part of the arrangement.

De-recognition of a financial liability

The agenda decision also includes guidance which requires an entity to assess and determine whether and when to de-recognise the liability (i.e., trade payable) that is part of the reverse factoring arrangements. To assess and determine this, an entity will need to follow the accounting requirements in IFRS 9 Financial Instruments. Upon de-recognition of the trade payable, an entity is then need to recognise a new financial liability owed to the financial institution and apply the requirements in IAS 1 on how to present the new financial liability in the statement of financial position.

Presentation of supply chain financing arrangement in the statement of cash flows

The next issue relates to the presentation of cash flows arising from the reverse factoring arrangement, particularly whether it should be presented as cash flows from operating activities or cash flows from financing activities. IFRIC believed that this assessment will relate to the earlier question on how such liability is presented in the statement of financial position. If such liability is presented as ‘trade and other payables’ that are part of the entity’s working capital, then the cash outflows to settle the liability is presented as cash flows arising from operating activities. However, if such liability is considered or represents the borrowing of the entity, then the cash outflows to settle the liability is presented as cash flows arising from financing activities.

The agenda decision also stated that if no cash inflows or cash outflows occur in a financing transaction, this transaction is to be disclosed elsewhere in the financial statements instead of the cash flows statement to provide the relevant information about the financing activity to the users of the financial statements. This is because investing and financing transactions that do not require the use of cash or cash equivalents are excluded from the statement of cash flows.

Notes to the financial statements

The agenda decision also touches on the necessary disclosures to be made concerning the supply chain financing arrangements. Particularly, IFRIC observed that supply chain financing arrangements:

- often gives rise to liquidity risk and as such, subject to IFRS 7 Financial Instruments: Disclosures requirements.

- involves judgement. Hence an entity discloses judgements that the management has made if such judgements have the most significant effect on the amounts recognised in the financial statements.

- maybe classified as cash flows from financing activities. Hence, disclosure for liabilities as part of the supply chain financing arrangement is to be included in evaluating changes in liabilities from financing activities.

The full agenda decision is available on the IASB’s website – Compilation of Agenda Decision published by IFRIC (Volume 4). Although this is just an agenda decision, it plays an important role and gives a significant impact on entities whose accounting policy is different from the agenda decision. We have covered the discussion on the role of IFRIC agenda decision in our article – IFRIC Agenda Decision: How does it affect you?

We will catch up with you again in our upcoming articles. Meantime, please enjoy other related articles in the Financial Accounting section.