In this article, we will discuss the accounting requirements in IAS 10 Events after the Reporting Period. Why is this standard needed? This standard governs the reporting of events that took place after the financial reporting period. Some people presume events that took place after the reporting date do not need to be reported or disclosed in the financial statements. This is not necessarily true. We will see later in this article, the events that took place after the reporting period may require entities to adjust their numbers in the financial statements while some do not affect the numbers.

Let us now go into the details of the requirements in IAS 10.

The definition of ‘events after the reporting date’

First of all, it is important to understand what does it mean by ‘events after the reporting date’? Which events we are referring to? What is the cut-off date? Does it cover all events, favourable events, or unfavourable events? Or does this mean all events which took place between the current reporting date to the next reporting period? Hence, entities need to be clear on the scope of the events govern under this standard.

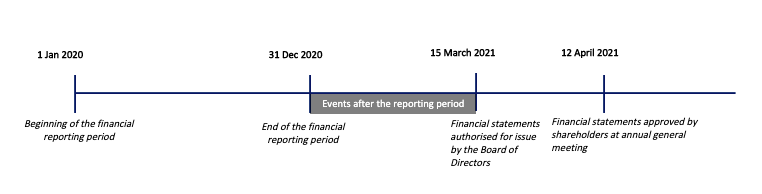

IAS 10 defines ‘events after the reporting date’ as events, regardless whether they are favourable or unfavourable, that occur between the end of the reporting period and the date when the financial statements are authorised for issue.

Take note that the date when the financial statements are authorised for issue may be different from one company to another, depending on the management structure, statutory requirements and procedures followed in preparing and finalising the financial statements. This is one of the critical judgement areas in IAS 10 – determining when the financial statement is authorised for issue – as it affects the determination of whether the events need to be reflected or disclosed in the financial statements for the current period. For example, a company that requires shareholders’ approval after the financial statements have been issued (i.e. approved by the board of directors), the financial statements are authorised for issue on the date when it is issued (or approved by the board of directors), not when the shareholders approve the financial statements at the annual general meeting. Events after the reporting period should also include events that took place after the public announcement of profit or other selected financial information.

Types of events and how they affect the financial statements

Let’s now understand the types of events and how they affect the financial statements. IAS 10 categorises events which took place after the reporting period into two types – adjusting and non-adjusting events. What are they?

An adjusting event is an event that provides evidence of conditions that existed at the end of the reporting period while a non-adjusting event is an event that is only indicative of conditions that arose after the reporting period. Entities will then need to assess and determine whether those events are indicative of the conditions that arose after the reporting period or they provide evidence of conditions that already existed at the end of the reporting period.

IAS 10 provides examples of events that are classified as an adjusting event such as:

- The settlement after the reporting period of a court case confirms that the entity had a present obligation at the end of the reporting period. In this example, the court case is the condition that existed at the end of the reporting period and the settlement provides additional evidence on the entity’s obligation. As such, the entity adjusts any previously recognised provision as per IAS 37 Provisions, Contingent Liabilities and Contingent Assets or recognise a new provision in the financial statements for the reporting period.

- The receipt of information after the reporting period which indicate that an asset was impaired at the end of reporting period, or that the amount of a previously recognised impairment loss for that asset needs to be adjusted.

- The discovery of fraud or errors that show that the financial statements are incorrect.

- The determination after the reporting period of the cost of assets purchased, or the proceeds from assets sold, before the end of the reporting period.

If an event is an adjusting event, IAS 10 requires entities to adjust the amount recognised in the financial statements. This is to reflect the effect of the adjusting event that occurred after the reporting period. However, if an event is a non-adjusting event, entities do not need to adjust the amounts recognised in the financial statements.

Other requirements for events after the reporting period

IAS 10 requires certain disclosures to be made in the financial statements in order to assist the users of the financial statements to understand how those events affect the numbers reported as at the reporting period. They are as follows:

- Entities must disclose the date when the financial statements were authorised for issue and who gave such authorisation. This is important information as it provides the cut-off date for events which were considered in the preparation of the financial statements.

- Entities are also required to update disclosure about conditions at the end of the reporting period. This is required even when the information does not affect the amount it recognises in its financial statements. For instance, entities may need to update their disclosures in relation to contingent liability in light of the evidence that becomes available after the reporting period.

- Entities are required to disclose the following information for the non-adjusting events after the reporting period, if they are material and must be disclosed for each material category of non-adjusting event:

- The nature of the event

- An estimate of its financial effect, or a statement that such an estimate cannot be made.

IAS 10 also provides guidance in relation to an entity’s ability to continue as a going concern. The fundamental concept in the preparation of financial statements is the ability of an entity to continue as a going concern. More on this is covered in Considerations for the presentation of financial statements. IAS 10 states that financial statements should not be prepared on a going concern basis if management determines after the reporting period either it intends to liquidate or to cease trading or that it has no realistic alternative but to do so. Events took place after the reporting period may require entities to re-consider whether the going concern assumption is still appropriate. For example, a deterioration in operating results and financial position after the reporting period. If the going concern basis is no longer appropriate, the financial statements must be prepared on some other basis of accounting, rather than an adjustment to the amount recognised within the original basis of accounting.

The last guidance provided in IAS 10 is in relation to dividend. IAS 10 states that if an entity declares dividend to the holders of equity instruments after the reporting period but before the financial statements are authorised for issue, such dividend do not need to be recognised as a liability at the end of the reporting period. This constitutes a non-adjusting event as the entity does not have the obligation to pay dividend at the reporting period.

The above summarises the key focus in IAS 10. We will bring you more technical discussion in our upcoming articles. Stay tuned for our upcoming articles by following us on social media. Meantime, enjoy other articles in Financial Accounting section or ask your queries by Joining on Community. It is free and open to join for all, now.