In this article, we have selected the top 5 accounting considerations that you should pay attention to for your FY 2020 financial statements. Having said this, there are plenty of other areas that you should also consider. The links are available in the Other Considerations and Resources section at the end of this article.

Let’s now get into the details.

#1. Going concern assumption in the preparation of FY 2020 financial statements

Paragraph 25 of MFRS 101 Presentation of Financial Statements requires an entity to assess the ability of the business to continue as a going concern. The standard defines going concern as the ability of the entity or company to continue in operation for a foreseeable future. This means an entity does not intend or does not need to enter into liquidation or to cease trading/business. This is fundamental principle because it affects the basis of the preparation of the financial statements.

If an entity is able to continue as a going concern, entities prepare the financial statements on going concern basis. Otherwise, entities must prepare their financial statements on another basis, for example, a break-up basis or any other appropriate basis. MFRS 101, however, does not provide further explanation on what are the other bases besides going concern.

Disclosure relating to going concern

MFRS 101 requires a disclosure on any material uncertainties that exist, as at the reporting date that may cast significant doubt on the entity’s ability to continue as going concern. If the COVID-19 pandemic affects your business’s ability to continue as a going concern, remember to disclose this fact in the financial statements. The disclosure also includes how management addresses those uncertainties.

Assessing the going concern assumption

To continue using going concern assumption during the current economic slow-down may require your attention and focus. Entities need to evaluate detailed cash flows forecasts up to the date of the authorisation for issuance of the financial statements. The evaluation includes an analysis of the company’s current and future profitability, debt repayment, and refinancing.

#2. Impairment of non-financial assets

MFRS 136 Impairment of Assets governs the accounting requirements for the impairment of non-financial assets. The standard requires an entity to assess whether there is any indication that an asset may be impaired.

The indications for impairment provided by MFRS 136 include both external and internal sources of information. They include the current economic environment, where an entity operates in, which has a significant impact on the way the assets are used or the ability of the asset to generate economic benefits. The evaluation of the economic benefits of an asset requires an entity to take into consideration cash flow projections from the use of the asset.

COVID-19 and impairment of non-financial assets

It is almost certain to say that the COVID-19 has significant impacts on the earnings and cash inflows. The reduction in market demand for goods and services may also affect the utilisation of an asset. In fact, some of the assets may also become idle. All these indications require an entity to assess the impairment loss for the non-financial assets for FY 2020 financial statements.

Additionally, pay attention to the cash flow projections. To clarify, the assumptions used in the past when estimating cash flows may no longer hold water during the current economic uncertainties. Long-term growth projection may also pose a significant challenge for an entity to quantify. Where your non-financial assets remain idle due to the low market demand, please also remember that depreciation will continue for those assets.

#3. Impairment of financial assets

MFRS 9 Financial Instruments generally governs the impairment of financial assets. The common financial assets that companies have are receivables, cash, and deposits. Under MFRS 9, impairment of financial assets is based on the expected credit loss model.

If you have good paymaster customers pre-COVID-19, please pay attention whether this is still valid in the current economic situation. Entities need to take into consideration the fact that many businesses are not doing well and individuals may also lose their job or having a pay cut.

In most situations, you will need to re-analyse the grouping of customers that you may have. It includes to further re-group and further sub-group them following the changes in risk profiles. Some customers may now pose a higher risk to your business as compared to pre-COVID-19. The collection of receivables may also become slower than before. Please also consider updating the expected risk of default when using the provision matrix to take into consideration the effect of the pandemic.

#4. Impact of loan moratorium scheme (borrowers’ perspective)

Some of the businesses may obtain loan moratorium or repayment holiday from financiers under the 6-month loan moratorium scheme. Under this scheme, borrowers do not need to repay the principal and interest of their loan instalments from April to September 2020. Some businesses may also be given additional relief under the targeted moratorium extension and repayment flexibility post-September 2020. This affects the numbers reported in the FY 2020 financial statements.

Under the MFRS 9, an entity needs to assess the impact of such payment holiday/flexibility. Some borrowers may enjoy little gains from the moratorium scheme, while others may suffer additional loss from this repayment holiday and flexibilities. Entities will need to reflect the impact in the numbers reported for FY2020 financial statements.

Assessing the impact from loan modification

When borrowers and lenders modify the contractual terms of the financing, such an event constitutes a modification of the financial instrument. Whenever there is a modification of a financial instrument, an entity shall assess whether such modification is substantial or non-substantial.

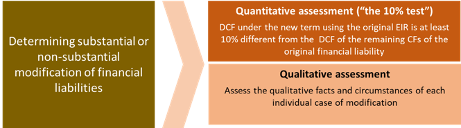

Why is the determination of substantial or non-substantial modification important? This is because the accounting and financial impact of the two are different. The diagram below gives a quick snapshot of the assessment/test to determine whether a modification is substantial:

Once the above has been determined, the next question is how do you reflect this in the book?

Accounting for substantial modification

If the modification is substantial, MFRS 9 requires a “de-recognition” of the old/original financial instrument and “recognition” of the new/modified instrument. Entities record the difference between these two amounts in profit or loss immediately as de-recognition gain or loss.

Take note that this is just an accounting entry. There is no actual cash flows movement in de-recognising the old instrument and recognising the new/modified instrument. So, the entries will be as follows:

Dr Old/original borrowing (Balance sheet) Cr New/modified borrowing (Balance sheet) Cr/Dr Gain/Loss on de-recognition (Profit or loss)

Accounting for non-substantial modification

If the loan moratorium is not substantial, MFRS 9 requires an entity to continue carrying the existing instrument. However, entities need to adjust the carrying amount due to the repayment holiday. Similar to the substantial modification, entities adjust the amount to profit or loss immediately as modification gain or loss. The following adjusting entry:

Dr/Cr Old/original borrowing (Balance sheet) Cr/Dr Modification gain/loss (Profit or loss)

Some of you may wonder what is the difference between substantial or non-substantial especially when entities record the impact for both in profit or loss? The answer to this is the amount recorded in your profit or loss will be different for substantial and non-substantial modification.

Quantifying the 10% test

From the quantitative assessment, it is important for you to pay attention on how you quantify the 10% test. For this, please watch out on two things:

- The effective interest rate used to discount the cash flows – remember to use the original effective interest rate to calculate the net present value of the cash flows – both the cash flows under the new modified terms and cash flows under the original terms; and

- Any transaction costs and fees – entities must be include this amount to determine the net present value of cash flows under the new terms. Please pay attention to the types of transaction costs and fees that can be included in the calculation.

The accounting after the adjustment for modification can also be tricky. Please also pay attention on how you account for the interest expense post-modification. For this, it requires you to understand what or which effective interest rate to use post-modification.

#5. Rent concession

The last area that we want you to also pay attention in your FY2020 financial statements is the rent concession. This is only applicable if you as a tenant (lessee) are given a rent concession by the landlord/lessor. If there is any rent concession given by the lessor, the general requirement of MFRS 16 Leases requires you to assess whether such rent concession constitutes a lease modification.

Applying the lease modification route under MFRS 16 can be challenging. This is because it requires an entity to remeasure the lease liability in the book using a revised discount rate if the lease modification is not a separate lease (it hard to argue that the rent concession is a separate lease). Assessing whether the rent concession constitutes a lease modification and getting the revised discount rate to remeasure the lease liability require some additional effort for most companies.

COVID-19 practical expedient for lessee on rent concession

Nevertheless, you can enjoy the practical expedient introduces under the COVID-19 related rent concessions amendments. Entities can apply the practical expedients provided meeting ALL of the following conditions:

- The rent concession given by the landlord is a direct consequence of the COVID-19 pandemic;

- The revised consideration for the lease substantially the same as, or less than, the consideration immediately preceding the change;

- The rent concession reduces only lease payments originally due on or before 30 June 2021; and

- No substantive change to other terms and conditions of the lease.

If this practical expedient is applied, the good news is that you recognise the negative variable lease payment arising from the forgiveness of lease payment straight away in the profit or loss. Additionally, entities continue to measure the interest accrue for the lease liability at unchanged incremental borrowing rate. What if your landlord only allows you to defer the payment of rent? Again, the difference in the present value of the lease liability under the rent concession to the original lease liability can also be recognised in profit or loss.

If your company is the landlord/lessor, unfortunately no practical expedient available for you. Accordingly, you need to apply the general requirements under MFRS 16 for lessor.

Other considerations and resources for FY 2020 financial statements

There are plenty of resources available on the net on the impact of the COVID-19 on financial reporting. Here is the list of guidance on a similar topic – locally and internationally – for your reading pleasure:

- Malaysian Accounting Standards Board (MASB) – COVID-19: MFRS 9 Financial Instruments – Expected Credit Loss Consideration and Q&A requirements in MFRS that Malaysian reporting entities may need to consider in respect of the impacts of COVID-19 are available at Covid-19-Related Guidance.

- Malaysian Institute of Certified Public Accountants (MICPA) – Accounting considerations due to the impact of COVID-19 is available at MICPA COVID-19 Resource & Support.

- International Federation of Accountants (IFAC) – The Financial Reporting Implications of COVID-19.

- Financial Reporting Council (FRC) – COVID-19 Thematic Review.