In this article, we provide you an introduction to accounting. Accounting is the process of recording financial transactions. The concept of financial accounting is actually relevant to business entities as well as to account for the financial transactions of an individual. However, accounting is common in recording financial transactions of a business or organisation because:

- Businesses or organisations need to report their financial information to oversight authorities such as companies commission or tax and customs offices.

- Not many individuals prefer to keep track or account for their own financial transactions. This information is not of use for other people.

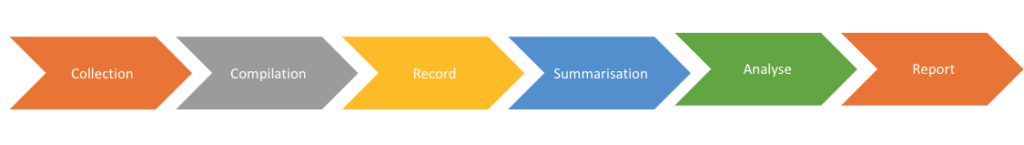

The accounting process comprises various activities. For example, the collection, compilation, recording, summarisation, analysing and reporting of the transactions in the financial report. In the following section, we will talk about how businesses account for transactions in the book.

The difference between accounting and book keeping

Some may be asking the difference between book-keeping and accounting. Or whether the two are essentially the same. Simply said, book-keeping is a subset of accounting. Book-keeping involves various activities up until recording the transactions in the book.

Accounting, however, brings more value than book-keeping. It involves making good use of the financial data captured from book-keeping by further summarising, analysing and reporting those data for the users of the financial reports.

A financial report is the output of the accounting process – churning various raw information and data into the story about the financial health of an entity.

The importance of accounting

The next question is on the importance of accounting. Would accounting still be important if business or organisation do not need to report to oversight authorities? The importance of accounting essentially goes beyond the mandatory compliance to authorities, although this is always the focus. Accounting is the main focus of any business.

Here we list out why accounting is important for – be it for-profit or not-for-profit entities:

- It tells the financial health of the entity – The accounting process helps any business or organisation to take stock of its financial information and standing at any point in time. Keeping the accounting record updated helps an entity to know its financial standing – strength and weaknesses. This information helps management to plan and strategise future direction or decisions that they need to take regarding their businesses.

- Accounting helps investors (current or potential), creditors and lenders to assess and evaluate the financial performance of an entity. Accounting provides crucial financial information of the business such as its profitability, gearing, liquidity, and others. Without accounting information, how would investors, creditors and lenders know an entity’s worthiness, profitability and performance?

- Accounting helps an entity to keep track of and monitor its financial affairs. It helps any business to monitor and take control of the assets and liabilities as well as income and expenditure of the business. Additionally, it also reduces fraud, forgery and misappropriation of money or other assets.

Types of the accounting method

Generally, there are three types of accounting method used to account for transactions:

- Firstly, the cash basis of accounting.

- Secondly, the accrual accounting.

- Thirdly, the modified cash basis of accounting.

The cash basis

Cash basis of accounting records transactions when the cash inflows or outflows take place. This means an entity will only record a transaction when payment or receipt is made (i.e. cash exchanges hand). This is regardless of whether the goods or services in the arrangement have been delivered or received. Under the cash basis of accounting, an entity will not record any accrual or prepayment in the book because the cash transaction is yet to take place.

Take this scenario as an example. On 12 August 2020, Company A sold 5 laptops to a customer. Company A will only get paid RM15,000 for the 5 laptops in one month. The laptops, however, are delivered to the customers on the same day of purchase. Using the cash basis of accounting, Company A will not record this transaction on 12 August 2020 as payment is yet to be received from the customer. In this situation, the transaction will not be recorded even after the items leave the Company’s inventory record.

An example of the cash basis of accounting is the Financial Reporting Under the Cash Basis of Accounting issued by the International Public Sector Accounting Standards Board (“IPSASB”).

The accrual basis

Accrual accounting is a method where entities record a transaction it has a right or obligation on an item. Most businesses or organisations use the accrual basis of accounting as it better reflects the financial performance of the entity, in the past as well as for future periods. The International Financial Reporting Standards (“IFRS”), the International Public Sector Accounting Standards (“IPSASs”), and US GAAP are examples of accounting frameworks that use an accrual accounting method.

In contrast to the earlier example, an entity records the transaction when it happens as it has a right for payment and satisfied its obligation to the customer. In such a situation, the company records a debtor of RM15,000 and revenue of RM15,000. This method provides a better reflection on the credit transaction and revenue earned on the said date although no actual cash exchanged.

The modified cash basis

The modified cash basis of accounting on the other hand, is a hybrid method. It combines the elements from the cash basis method and the accrual method. Under this method, entities record long-term assets such and long-term debts using the accrual method. Additionally, entities record short-term assets using the cash method.

The Accounting Framework: Why does it matter?

An accounting framework sets out the accounting principles and rules that an entity needs to follow in recording a transaction or event. In the absence of an accounting framework, you would expect each entity to account and report a transaction or event in their own way as they deem fit, based on their interpretations. Consequently, it leads to inconsistent accounting treatment for similar transactions between one company to another.

Inconsistency makes it difficult for the users of the financial statements to analyse and compare performance of a company against its peers in the market. As such, an accounting framework helps to promote a consistent application of accounting principles and rules. Hence, benefit the users and achieve the objective of preparing the general purpose financial statements.

In Malaysia, there are three types of accounting framework which are the Malaysian Public Sector Accounting Standards (“MPSAS”), the Malaysian Private Entities Reporting Standards (“MPERS”) and the Malaysian Financial Reporting Standards (“MFRS”). Head out to our article Financial Reporting Frameworks in Malaysia to learn more.