In our previous article Considerations for the presentation of financial statements in the Accounting 101 series, we explained that the IAS 1 Presentation of Financial Statements covers various components and principles in the preparation of the financial statements. In that article, we have shared with you the first two components covered in IAS 1 – a complete set of financial statements and the general features of financial statements.

This round, we explain the remaining topics which are the structure and content of financial statements and other disclosures as required by IAS 1. With this, readers will be able to appreciate what are the minimum information that entities must disclose in the financial statements. Additionally, we also touch on the factors that entities should consider in structuring and presenting their financial statements.

What are the required structure and content of the financial statements?

IAS 1 discusses few areas in relation to the structure and content of the financial statements. They are:

- the identification of the financial statements;

- the statement of financial position;

- the statement of profit or loss and other comprehensive income;

- the statement of changes in equity;

- the statement of cash flows; and

- the notes to the financial statements.

Let’s now look at the requirements above.

1. Identification of the financial statements

IAS 1 requires an entity to display display the following information clearly. It includes to repeat them if it necessary for the users to identify the entity’s financial statements:

- Name of the reporting entity – If an entity changed its name since the previous reporting period, it must disclose the fact. In practice, you will see the new name displayed together with the old name (labelled as ‘formerly known’).

- Separate or group financial statements – Entities may prepare separate or group financial statements. When an entity prepares both separate and group financial statements, the financial statements and corresponding financial information are clearly labelled as ‘company’ or ‘group’.

- The reporting period – Entities must disclose the date of the end of the reporting period or period covered by the financial statements.

- The currency – IAS 1 also requires an entity to disclose the presentation currency used in the preparation of the financial statements.

- The level of rounding – An entity must also disclose the level of rounding used in presenting the amounts in the financial statements if this is the case.

2. Statement of Financial Position

Paragraph 54 of IAS 1 provides a long list of line items that an entity must present in the statement of financial position. An entity presents them if they are material. These line items are generally items that are sufficiently different in nature or function. Hence, warrant a line item on its own. Nevertheless, an entity needs to assess whether presentation of an additional line item is necessary based on the following:

- Nature and liquidity of the assets;

- Function of assets within the entity; and

- Amount, nature and timing of liabilities.

IAS 1 also allows for an entity to present subtotals, so long that they are relevant to the users’ understanding.

Presentation of current and non-current classification

Entities need to present their statement of financial position based on current and non-current classification. This means, in the statement of financial position, entities present current and non-current assets and current and non-current liabilities.

There is however, an exception to this. It is when a presentation based on liquidity provides information that is more relevant and reliable. The financial statements of entities in the financial services industry such as commercial banks, investment banks and insurance entities are generally prepared based on this basis. Nevertheless, regardless of the presentation choice, entities will need to disclose the amount expected to be recovered or settled after more than 12 months for each asset and liability line item that combines amount expected to be recovered or settled:

- No more than 12 months after the reporting period; and

- More than 12 months after the reporting period.

IAS 1 also provides guidance on classifying assets and liabilities as current or non-current. We have explained in Liability and equity on the current and non-current classification of liabilities.

Current and non-current classification for assets

IAS 1 states that an asset is classified as current when an entity:

- expects to realise the asset, or intends to sell or consume it in its normal operating cycle;

- holds the asset primarily for the purpose of trading;

- expects to realise the asset within twelve months after the reporting period; or

- the asset is cash or cash equivalent unless the asset is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period.

Entities classify an asset that does not meet any of the above as non-current. This principle, however, does not apply to deferred tax assets and liabilities. Deferred tax assets and liabilities are classified as non-current in the statement of financial position.

3. Statement of Profit or Loss and Other Comprehensive Income

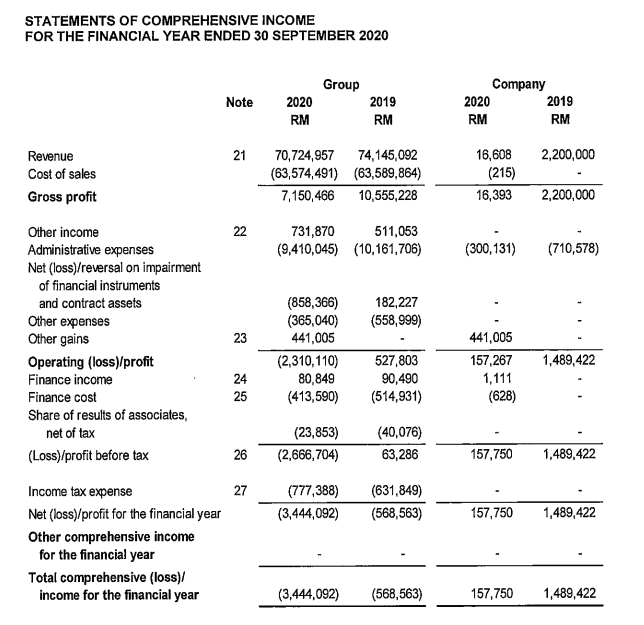

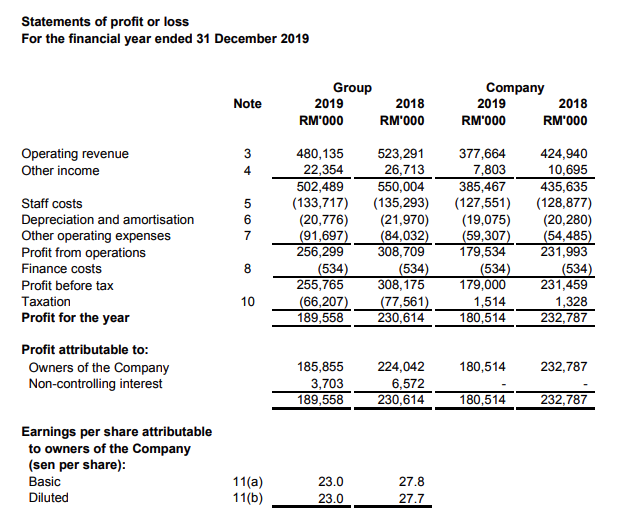

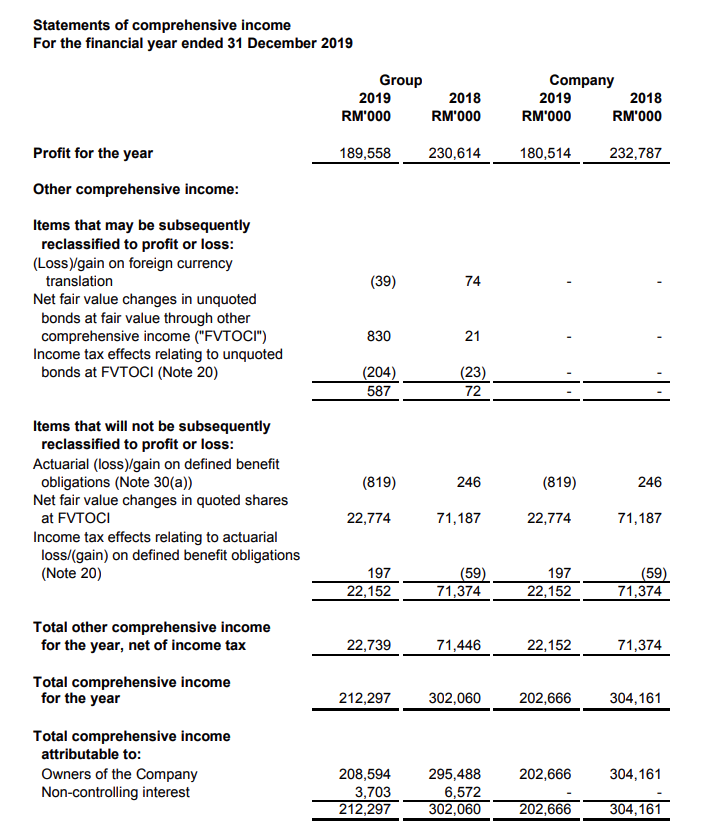

Entities present a statement of profit or loss and other comprehensive income either as a single statement (i.e., statement of comprehensive income) or as a two-separate statement.

In a single statement, there will be two sections which are the profit or loss section followed directly by the other comprehensive income section. Total comprehensive income will be the total of the two sections. In contrast, in the two-separate statement, entities segregate the statement of profit or loss from the statement of comprehensive income.

Let’s see examples for you to compare the two approaches:

- Manforce Group Berhad’s audited financial statement for the financial year ended 30 September 2020

- Bursa Malaysia Berhad’s audited financial statements for the financial year ended 31 December 2019

IAS 1 again stipulates line items that entities need present in the statement of profit or loss or profit or loss section (under single-statement approach), if they are material. Additionally, for items in the other comprehensive income, IAS 1 requires entities to further segregate them into items that will not be reclassified and items that will be reclassified to profit or loss.

Entities present items in the statement of profit or loss or the profit or loss section based on either their nature or function. Either presentation based on nature or function, the selection made must be based on providing more relevant and reliable information to the users.

4. Statement of Changes in Equity

IAS 1 emphasises that entities must include the following information in the statement of changes in equity:

- The separation of total amounts attributable to owners and non-controlling interest in relation to the total comprehensive income for the period;

- Effect of retrospective application or restatement on each component of equity; and

- A reconciliation between the beginning amount and the closing amount for each component of equity.

IAS 1 additionally provides some other requirements on information that entities must present in the statement of changes in equity or in the notes to the financial statements.

5. Statement of Cash Flows

IAS 1 does not provide any explicit requirements with regard to the statement of cash flows. This is because there is a specific or separate standard on its own that governs the requirement for the statement of cash flows. IAS 1 makes reference to IAS 7 Statement of Cash Flows for the presentation and disclosure of cash flow information.

Notes to the financial statements

The following are general principles on information that an entity needs to present and disclose in the notes to the financial statements:

- information on the basis of preparation of the financial statements and specific accounting policies used or adopted by the entities;

- disclosures of information required by IFRS that are not presented elsewhere in the financial statements; and

- to provide information that is relevant to users’ understanding but not presented elsewhere in the financial statements.

Other important information that an entity needs to disclose are:

- The significant judgments – These are judgments that entities have made in the process of applying the entities’ accounting policies. The significant judgment made are those that have the most significant effect on the amounts recognised in the financial statements.

- The significant assumptions – These are assumptions that entities made about the future and other major sources of estimation uncertainty at the end of the reporting period. The assumptions and estimation uncertainty should have a significant risk of resulting in material adjustments to the numbers of assets and liabilities reported in the financial statements within the next financial year.

- Capital management – Disclosure on the capital management covers the objective, policies and processes for managing capital. It also include whether an entity complies or has not complied with any externally imposed capital requirement and the consequence if not comply.

Future development on the structure and content of the financial statements: What’s next?

It is also interesting to bring to your attention that the International Accounting Standards Board (“IASB”) has embarked into the Better Communication in Financial Reporting project with few project themes. The project aims to make financial information more useful and improve the way entities communicate financial information to the users.

IASB issued an exposure draft on General Presentation and Disclosures back in December 2019. It proposed changes or amendments to the requirements about the information on the performance of the profit or loss. Additionally, it also proposed some limited changes to the statement of cash flows and the statement of financial position. At this juncture, IASB is still deliberating the comments received from the public and future direction on the project.

The discussion on the general presentation, structure and content of financial statements in our Accounting 101 series remain relevant until the IASB finalises any amendments to the existing requirements. We will keep you posted on future development in this area. Till then. Stay tuned!