Interest rate is one of the important elements in the financing arrangement. The types and calculation of interest rates may be different from one product to another. Interest is reported either as interest expense or interest revenue in the statements of profit or loss and other comprehensive income. Interest calculation also affects the carrying amount of assets and liabilities in the statement of financial position such as loans and receivables and borrowings. The interest rate charged or contractually agreed by the lenders may also be different from the interest rate to be accounted for under the financial reporting requirements.

Let’s see briefly the various types of interest rates in the market in this Accounting 101 series.

Various type of interest rates

There are three types of interest rate commonly used in the market which are:

- Flat interest rate;

- Fixed interest rate; and

- Floating or variable interest rate.

In some products, the type of interest rate can also be a combination of the above types. Let us now see the difference between the three types of the interest rate.

Flat interest rate

A flat interest rate is a type where interest is charged based on the original loan or financing amount. The total interest is locked regardless of the movement in the principal and interest payment made during the loan tenure. Accordingly, the total interest to be paid by the borrower is the same throughout the loan or financing period. How do we compute the interest for flat rate interest? The flat interest rate is computed based on the following formula:

Total interest payable = Original loan amount x Flat interest rate (per annum) x Number of years

Interest charged on the borrowers or received by the lenders remains the same throughout the loan period. For example, a borrower obtained a USD50,000 loan at a flat interest rate of 7% per annum. The tenure of the loan is 5 years. Using this example, the total interest for the loan throughout the period is USD17,500 (or yearly interest of USD3,500 throughout the loan period).

Fixed interest rate

A fixed interest rate is a type where interest is computed based on a fixed percentage or rate of interest. This rate will not change regardless of whether there is a movement in the interest rate for lending and borrowing in the market. The same rate is applied throughout the loan tenure. For example, if a borrower obtained a loan at an interest rate of 7% per annum, the 7% rate will stay the same throughout the loan period regardless of whether the market interest rate went up or down. This means, fluctuation in the market interest rate is completely ignored and the interest rate remains unchanged. However, as compared to the flat interest rate, the interest charged for fixed interest rate will change depending on the movement in the outstanding amount of loans or borrowing of the period. Fixed interest rate is computed based on the following formula:

Interest payable (period) = Outstanding loan amount x Fixed interest rate (period)

Although the rate of interest remains the same throughout the loan period, the interest from one period to another will not be the same if there is repayment of principal by the borrowers. Let’s take an example. A borrower obtained a loan with a fixed interest rate of 12% per annum. The outstanding balance of the loan at the beginning of the year stood at USD15,674. Repayment for each month is USD500. The interest charge for January is USD151.74 (being USD15,674 – USD500 multiply by 1%) and the interest charge for February is USD146.74 (being USD15,174 – USD500 multiply by 1%). Although the rate of interest is fixed, the interest charge will move when there is a movement in the outstanding amount arising from the repayment of principal.

Floating interest rate

Floating interest rate is a type where interest is charged based on a base/index rate of interest. The interest to be charged will move when there is a movement in the market or index rate used in setting or determining the interest. Floating interest rate is also commonly known as variable interest rate as the interest fluctuates throughout the loan or borrowing period. For example, the interest rate is set based on the market base lending rate plus a margin for certain products. Whenever the regulatory authority resets the market base lending rate to a higher or lower rate, the interest amount will also be higher or lower. The common benchmark rates (or reference rates) use to set the floating interest rate are Base Lending Rate (“BLR”), Base Financing Rate (“BFR”), London Inter-Bank Offered Rate (“LIBOR”) and Overnight Policy Rate (“OPR”).

Interest payable (period) = Outstanding loan amount x Floating interest rate (period)

Borrowers subjected to the floating interest rate are exposed to the risk of changes in the reference rate. If the reference rate goes up, borrowers will need to pay higher interest and vice versa. Nevertheless, certain products and instruments come with a ceiling rate where the interest to be charged to the borrowers can only go up to a certain limit. No additional interest will be charged if the interest exceeds the ceiling amount.

Comparison of the three types of interest rate

Below is the summary of comparison of the three types of interest rate:

| Flat rate | Fixed rate | Floating rate | |

|---|---|---|---|

| Interest rate | The interest is locked based on the original loan amount and does not change throughout the loan period. | The rate of interest is fixed and does not change throughout the loan period. | The rate of interest moves according to the movement in the market or benchmark rate. |

| Interest charged | Total interest remains flat/unchanged throughout the tenure. | Total interest moves according to the movement in the repayment pattern | Total interest moves according to the movement in the repayment pattern and the movement in the interest rate. |

Recognition of interest

In this section, we will discuss how companies allocate the interest and recognise them in their books. Generally, there are three methods of interest allocation which are:

- Sum-of-digit method;

- Effective interest rate method; and

- Proportionate interest method

The difference between the three methods is explained further below.

Sum-of-digit method

Certain lenders use the sum-of-digit (“SOD”) method to allocate and recognise interest. This method is also known as Rule of 78 (total sum of months in a year which is 1+2+3+4+…+12). The sum-of-digits depends on the loan tenure – the total sum of digit for a 2-year loan is 300 which is 1+2+3+4+…+24, total sum-of-digit of 666 for a 3-year loan and others. Interest is computed by dividing each digit by the total sum-of-digit. Under this method, borrowers will generally be required to pay a high interest portion in the earlier part of the loan period and decrease gradually over the period (reverse order).

The early repayment of the loan (repayment amount consists of repayment of principal and interest payment) is hugely allocated to the interest payment and less to the principal amount. Under this method, the lender will recognise huge interest profit at the beginning of the loan tenure and gradually decrease over the year(s). From the borrower’s perspective, the impact will only be “felt” when borrowers want to pay-off their loan (i.e., settlement of loan) before the end of the loan tenure.

Effective interest rate method

The effective interest rate method considers the effect of compounding over the loan tenure (time value of money). Effective interest rate is also used to compare loans with different tenure and interest rates. Because effective interest rate takes into consideration the compounding effect, the effective interest rate shows the real percentage rate owed in interest and may be different from the published or contractual rate. Similar to the sum-of-digit, the effective interest rate method also allocates higher interest at the early repayment period and gradually decreases over the period.

Proportionate interest method

This method is commonly used to allocate profit under the Accounting and Auditing Organization for Islamic Financial Institutions (“AAOIFI”) framework. This method is, however, commonly associated with the straight-line allocation of profit over the financing tenure. AAOIFI allows profit to be allocated based on a proportionate basis for certain financing, namely for the Ijarah, Murabahah and deferred payment sale.

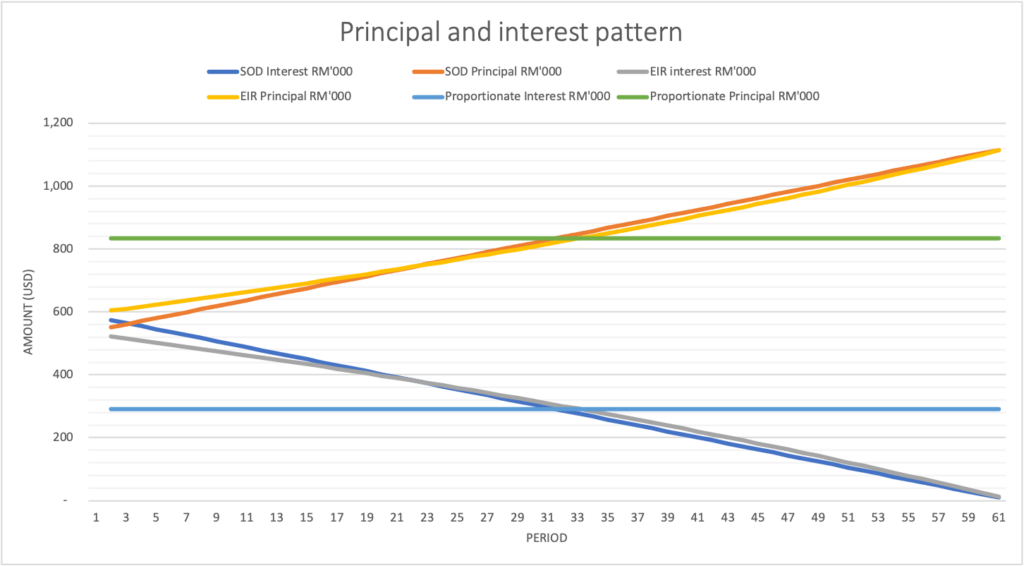

Principal and interest pattern for the three methods

To better understand the repayment pattern of the above methods, let’s take an example. A company provides a borrower with a hire-purchase loan of USD50,000 for five years, with a flat interest rate of 7% per annum. The total sum of months for this 5-year loan is 1,830 and the total flat interest of the loan is USD17,500 (USD50,000 x 7% x 5 years).

From the chart above, it can be observed that under the proportionate interest method, the lenders will recognise repayment of principal and interest proportionately whenever borrowers make the repayment installment. While under the effective interest rate and sum-of-digit method, lenders will allocate a larger amount to the interest in the early period of the loan tenure and gradually decrease over the period. Because a larger amount of installment is allocated to interest, this resulted in a lesser portion being allocated as repayment of principal.

Calculation of interest for financial reporting purpose

For financial reporting purposes under the IFRS framework, an entity is required to measure the loans and borrowing at amortised cost under IFRS 9 Financial Instruments. The measurement under the amortisation method requires an entity to use the effective interest rate method to determine the carrying amount of loans measured at amortised cost, borrowing as a liability and interest income or expense. To read more about this, you can refer to Accounting for financial assets and Liability and Equity in Accounting 101 series.