In this article, we continue to discuss another Islamic contract, Ijarah. We also cover in this article on how Ijarah contract is commonly applied in Islamic finance products.

What is Ijarah?

Ijarah refers to a contract or an arrangement whereby lessor leases its asset(s) to lessees at rental agreed by both parties. In this arrangement, a lessor allows the lessee to enjoy the benefit or usufructs of the asset/property at an agreed rental and period.

Although Ijarah is commonly used in leasing of an asset, it is also applicable in employment of service. As such, there are to types of Ijarah contract:

- Ijarah Al-‘Ayn – a lease contract of an usufruct of an asset to another party in exchange for a consideration

- Ijarah Al-‘Amal – a hire contract to employ a person in return for consideration (wages) for his/her services.

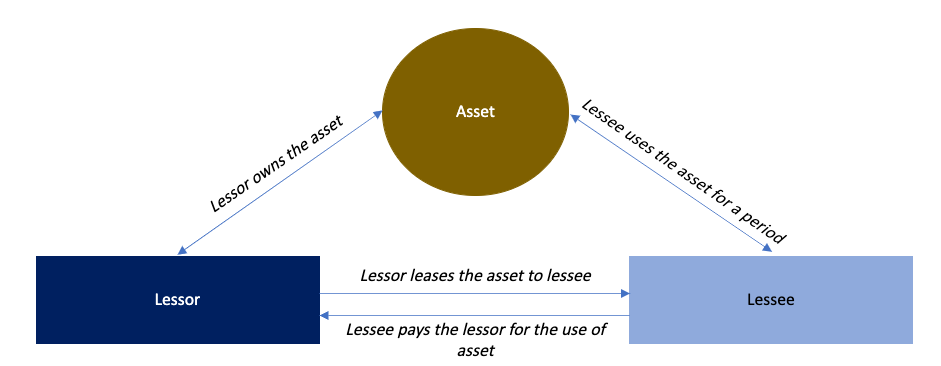

The basic Ijarah arrangement is as follows:

As illustrated above, in a basic Ijarah arrangement, the lessor continues to own the Ijarah asset at the end of the Ijarah period. Lessor does not transfer the ownership of the asset to the lessee.

There is another type of Ijarah which is Ijarah Mawsufah Fil-Dhimmah. This Ijarah is also know as forward lease Ijarah. In contrast to the basic Ijarah arrangement, the asset under Ijarah Mawsufah Fil-Dhimmah is not yet available at the contract inception.

Lessor will constructs the asset as per the lessee specification. However, the asset will only be delivered at an agreed date in the future. The lessor may ask the lessee to pay a certain portion of pre-agreed rental during the construction of the asset. This type of lease is relevant in property and asset under construction.

Conditions for Ijarah

The following are the conditions for a valid Ijarah contract:

- Both parties – lessor and lessee must meet the contracting party conditions. The conditions among others are be sound of mind and attained the age of maturity.

- The existence of the object of the contract which can either be asset or equipment or benefit or usage.

- The lessor and lessee must agree and determine by the rent at the contract inception.

- There must be a term or period of the Ijarah arrangement agreed by both parties at the inception of the contract.

- Offer and acceptance of Ijarah arrangement between the parties.

The application of Ijarah in Islamic Finance

Let us now see how financiers apply Ijarah contract in their Islamic Finance products.

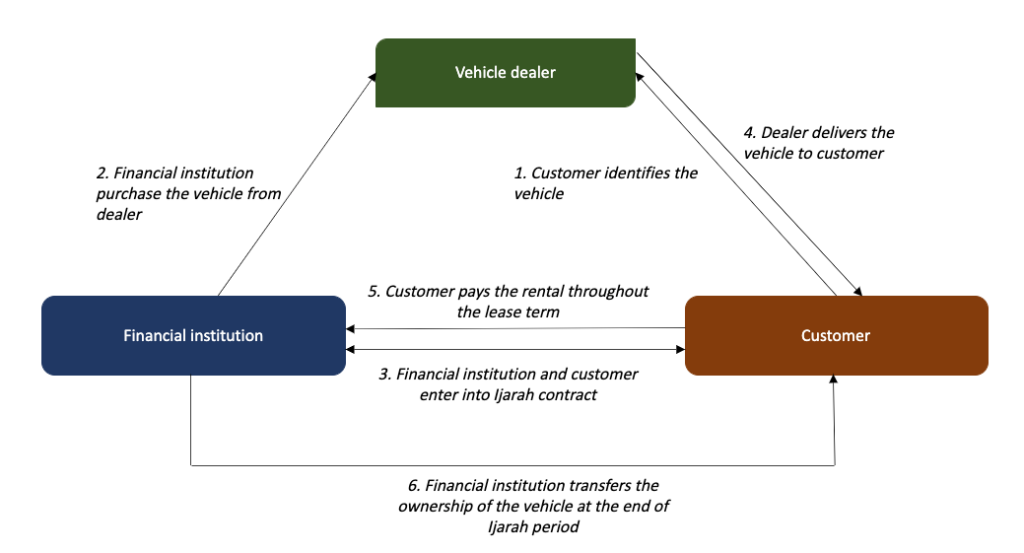

Ijarah contract is common in hire purchase financing. In this regard, customers seek financing from the financial institution to finance their purchase of assets. The financial institutions do not have an intention to own the asset and just a mere financing provider in the arrangement. Customers on the other hand, have the intention to own the assets at the end of the financing period. Because of this, Ijarah contract often comes with a transfer of ownership to the customers at the end of the financing/leasing tenure. The transfer of ownership of the asset at the end of Ijarah period can either be through sale or gift contract.

Two common Islamic Ijarah products are Ijarah Thumma Al-Bay’ (“AITAB”) and Ijarah Muntahiya Bil-Tamleek (“IMB”). AITAB is a lease arrangement that ends with a sale at the end of the lease term. As such, AITAB consists of two contracts: (i) contract of leasing (Ijarah) and (ii) sale contract (bay’). IMB on the other hand comes with an option for the lessee to own the asset at the end of the lease period. The option to own the asset can be done via transfer of ownership through a gift to a sale for a nominal amount or amount agreed by both parties.

The diagrams below illustrate the application of AITAB and IMB:

In AITAB arrangement, it is important to note that the Ijarah and the sale contract at the end of the lease period, to be independent from one another. This means, financial institution will only execute the sale contract on expiry of the Ijarah contract.