As a quick recap, our previous article on the primary source of Islamic laws has explained that the sources of Islamic laws can be divided into two categories – primary and secondary sources. The Al-Quran, Sunnah, Ijma’ and Qiyas are the primary sources of Islamic laws.

Let us now continue with the secondary sources of Islamic laws. Secondary sources are crucial in developing various contemporary issues evolving Islamic Finance practices in the current environment.

The secondary sources of Islamic laws

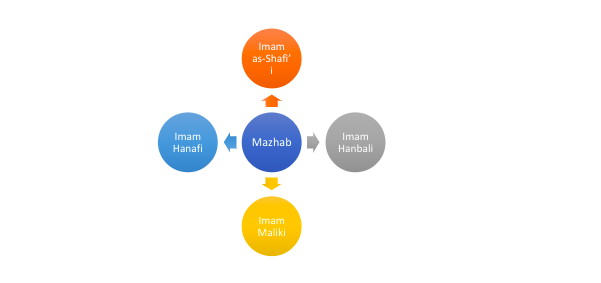

There are four secondary sources of Islamic laws which are (1) maslahah; (2) istihsan; (3) urf; and (4) istishab. These secondary sources of Islamic laws use the same principle as qiyas, which is the deduction of Islamic laws and opinion based on the use of discretion. Because the rulings and opinions are based on discretion, this leads to some differences among various schools of thought. There are four schools of thought or mazhab commonly referred to by the Muslims which are Mazhab Imam as-Shafi’i, Mazhab Imam Hanbali, Mazhab Imam Maliki and Mazhab Imam Hanafi.

Let us now go into the details on each of the secondary sources of Islamic laws.

1. Maslahah

Maslahah is the consideration of public interest or benefit in deriving the rulings. Deriving the rulings based on maslahah aims at protecting the five core values of the Shariah which are:

- Protection of the religion;

- Protection of life;

- Protection of intellect or mind;

- Protection of property; and

- Protection of progeny.

Any rulings that uphold these core values or evading the mafsadah (evil) fall within the concept of maslahah. What are the precautions so that maslahah is not simply used for individual or certain groups’ bias and preference? There are certain considerations when using maslahah in deriving the rulings:

- The maslahah must be general and aimed at preventing harm or protecting the public interest at large. Maslahah should not be used to a particular person or a group of persons. It should give the benefit or interest to the largest possible number of people in the society.

- Maslahah should not be in any conflict with the injunctions or principle and value upheld in the Al-Quran, the sunnah or ijma’.

- The rulings to be made using maslahah must derive more benefits than harms – i.e., benefits outweigh harms that possibly come from such rulings.

In the current economic scenario, an example of the use of maslahah is the application of London Interbank Offered Rate (“LIBOR”) as a profit benchmark rate. Although some scholars are not in favour of such practice in Islamic transaction, it is a maslahah to use it in the absence of alternative benchmark rates that can be used by Islamic financial institutions. This enables the Islamic financial institutions to operate in the current banking practice of profit and mark up.

2. Istihsan

Istihsan (juristic discretion) is a method used to come to a decision that sets aside an established dalil (i.e., guide) for a reason that justifies such a departure (i.e., to depart from an existing rule or precedent). Istihsan is used in deriving an opinion to avoid rigidity or inflexibility from the enforcement of certain rulings. Istihsan is done for a reason stronger than the reason achieved for the original dalil, particularly as it seeks to uphold a higher value of Shariah. For example, a departure from the general rule that prohibits selling an object which is not in the seller’s possession in salam contract (sale of an object where the price is paid now but the delivery of the item is to be made in the future). Not all scholars accept the utilisation of istihsan in the formulation of a decision. Some scholars reject the practice of istihsan, but this rejection is limited for those who misuse istihsan to provide legal validity for inappropriate ijtihad (independent reasoning).

3. ‘Urf

‘Urf is an Arabic term that refers to the customary practice or knowledge of the people or given society (i.e., social tradition). The word “customary” indicates that the sayings or actions are applied repeatedly until such words or actions are accepted by society. However, should there be any disagreement between the customary practice or knowledge against the Al-Quran and the Sunnah, such customary practice and knowledge are disregarded. For example, it is the customary practice of society to divide the wealth and inheritance equally between the son, daughter and adopted children. However, as the Al-Quran has clearly stipulated the distribution of inheritance for Muslim family, this social tradition cannot be accepted on the basis of ‘urf. In such a situation, such customary practice should be abandoned or disregarded. In another example, it is common for settlement of payment and delivery on the T+3 period in the current financial system. Accordingly, the settlement on the T+3 is still considered a spot transaction based on ‘urf for the current payment system of the society.

4. Istishab

Istishab refers to the principle of the presumption of continuity. Istishab holds the principle where the rulings given in the past are presumed to be valid until there is new evidence that suggests otherwise or contrary to the earlier rulings. This presumption applies to both the positive and negative rulings. This means if in the past a specific rule was proved as positive, such rule will remain positive until there is proof or evidence which suggests otherwise is established. For example, a concluded contract is Shariah compliance until there is proof that suggests otherwise.

Primary sources are fundamental to support the use of discretion in developing Islamic rulings for secondary sources. With the conclusion of this article, we hope you can now appreciate how primary and secondary sources contribute to the development of rulings in Islamic finance. If you need a recap on what is Islamic finance and why there is a need for Islamic finance, you can refer to Introduction to Islamic Finance.